- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

banking sector

Update news banking sector

Banking sector optimistic despite ongoing conflict in Europe

It's too early to tell how the ongoing Russia-Ukraine conflict will affect Vietnam's banking sector, said industry experts.

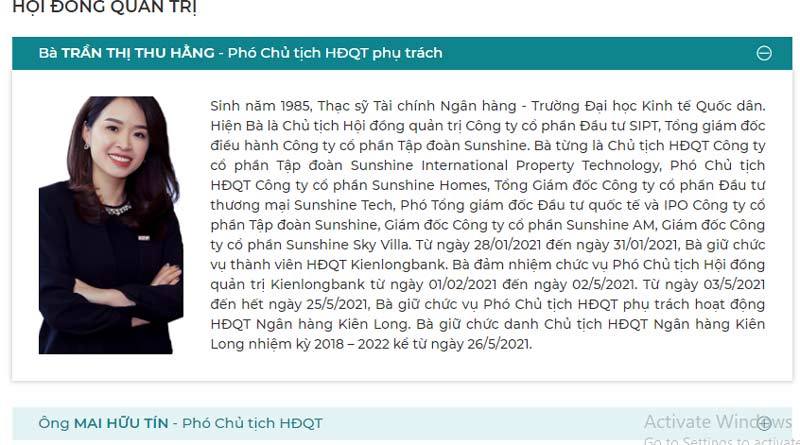

More local banks have young leaders

Ms. Tran Thi Thu Hang, CEO of Sunshine Group, has become the youngest leader in Vietnam’s banking industry after being appointed chairwoman of KienLongBank.

Local banks target high profits

During the “season” of shareholders’ meetings, Vietnamese banks are confident about their plans to increase profits by several trillion dong in 2021. Several banks have set a record growth target of up to 30%-50%.

Officials highlight circular economy, macro-economic stability at Party Congress

Minister of Natural Resources and Environment Tran Hong Ha on January 27 emphasised the importance of a circular economy

Amid favorable conditions, bank listings on the rise

In the context of favorable conditions on the stock market which saw the indices rising sharply over the past eight months, getting listed at the moment will give banks better valuation and make it easier for them to attract greater cash flows,

Vietnam banking sector to suffer in 2020 before rebounding in 2021

Fitch Solutions expected credit growth to weaken to 7% in 2020 from 13.7% in 2019, but the growth is predicted to pick up to 12% one year later.

EVFTA paves way for European investors to contribute capital to Vietnam’s banks

Within five years from the day the FTA takes effect, Vietnam pledges to consider European credit institutions’ proposals to allow them to hold up to 49 percent of shares in two Vietnamese joint stock banks.

Within five years from the day the FTA takes effect, Vietnam pledges to consider European credit institutions’ proposals to allow them to hold up to 49 percent of shares in two Vietnamese joint stock banks.

Banks to provide over $12-billion credit to epidemic-hit firms

The banking sector is building a credit support programme with a value of $12.2 billion for firms hit by COVID-19, in an attempt to help ease their difficulties, according to an official of the State Bank of Vietnam.

The banking sector is building a credit support programme with a value of $12.2 billion for firms hit by COVID-19, in an attempt to help ease their difficulties, according to an official of the State Bank of Vietnam.

Banks warn of rising fraudulent websites, stolen accounts

Banks have advised account owners to be vigilant as fraudulent activities, both online and offline, are on the rise.

Banks have advised account owners to be vigilant as fraudulent activities, both online and offline, are on the rise.

Pending frustrations in M&A unnerve investors

Though mergers and acquisitions in Vietnam’s banking sector have ballooned recently, tie-ups between foreign and local lenders are not without their drawbacks.

Though mergers and acquisitions in Vietnam’s banking sector have ballooned recently, tie-ups between foreign and local lenders are not without their drawbacks.

The highlights in the banking sector in 2019

2019 witnessed low credit growth rate.

Vietnam banks thrive in 2019, profits exceed targets

2019 has been a good year for the banking sector. Most commercial banks performed well with profit results exceeding the targets set earlier in the year.

2019 has been a good year for the banking sector. Most commercial banks performed well with profit results exceeding the targets set earlier in the year.

State firms make up 5% of total corporate loans in Vietnam

A major proportion of bank loans are provided for the business community, particularly the private sector and individuals.

A major proportion of bank loans are provided for the business community, particularly the private sector and individuals.

Vietnam to consider reducing ownership at state-run commercial banks

Vietnam is committed to opening the financial market to foreign investors, particularly in financial services.

Vietnam is committed to opening the financial market to foreign investors, particularly in financial services.

How much should VN customers spend on information security solutions?

Ensuring information security is increasingly important as more online transactions are made. However, the budgets for information security allocated by financial institutions remain modest.

Ensuring information security is increasingly important as more online transactions are made. However, the budgets for information security allocated by financial institutions remain modest.

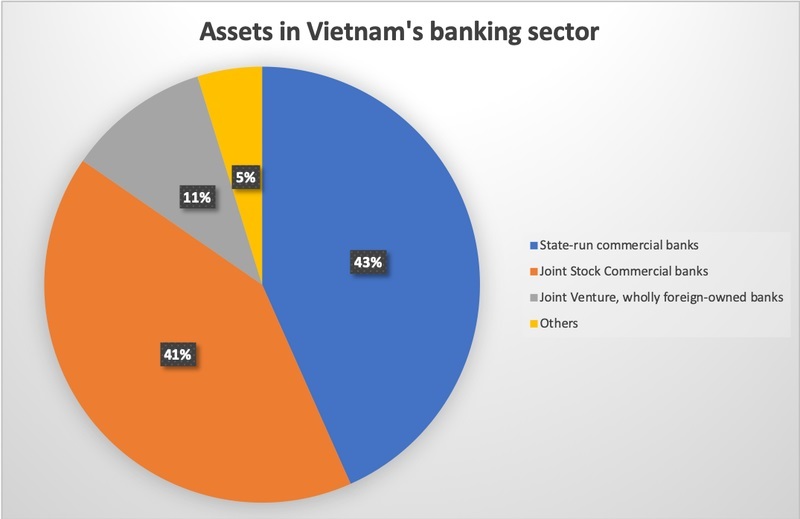

Total assets of banks in Vietnam increase 9% to nearly US$520 billion

The total assets of commercial banks under state ownership accounted for 43.4% of the total of the banking sector, followed by joint stock commercial banks with 41.4%.

The total assets of commercial banks under state ownership accounted for 43.4% of the total of the banking sector, followed by joint stock commercial banks with 41.4%.

Vietnam’s banking sector becomes more attractive to investors

Growing attractiveness of Vietnamese banks' shares is thanks to a positive revamp and strong outlook of the sector, particularly as Vietnam is accelerating global economic integration.

Growing attractiveness of Vietnamese banks' shares is thanks to a positive revamp and strong outlook of the sector, particularly as Vietnam is accelerating global economic integration.

VN banks lower savings rates but base rate could still be high

Several local banks have reduced their interest rates in recent days, going against the banking sector’s general year-end trend of increasing rates to boost earnings.

Several local banks have reduced their interest rates in recent days, going against the banking sector’s general year-end trend of increasing rates to boost earnings.

Postive changes made to resolve Vietnamese banks' bad debt

The banking sector had made considerable headway into settling bad debt, restructuring credit institutions and developing the banking system two years since the National Assembly issued a resolution on the industry.

The banking sector had made considerable headway into settling bad debt, restructuring credit institutions and developing the banking system two years since the National Assembly issued a resolution on the industry.

Foreign and Vietnamese banks in hot race

With great advantages being held by foreign banks, Vietnamese banks find it difficult to compete.

With great advantages being held by foreign banks, Vietnamese banks find it difficult to compete.