- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

BIDV

Update news BIDV

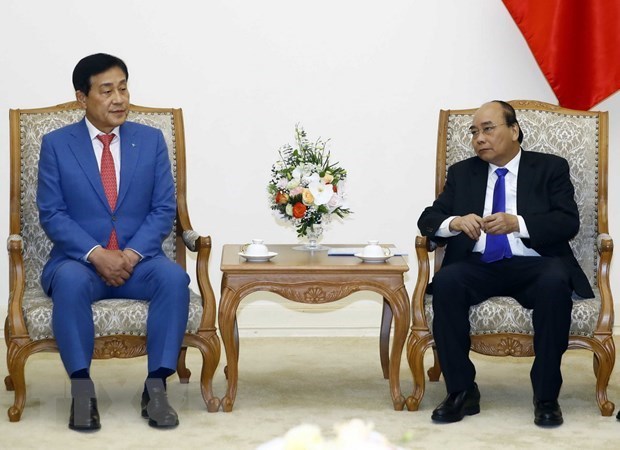

Prime Minister Nguyen Xuan Phuc greets Chairman of Hana Financial Group Inc.

The Vietnamese Government will create the most favourable conditions for firms from the Republic of Korea (RoK) to operate successfully in Vietnam, Prime Minister Nguyen Xuan Phuc said on November 11.

The Vietnamese Government will create the most favourable conditions for firms from the Republic of Korea (RoK) to operate successfully in Vietnam, Prime Minister Nguyen Xuan Phuc said on November 11.

Vietnam’s credit growth projected to reach 10-year low of 13.2% in 2019

The slow growth comes mainly from state-owned banks, which have become more stringent on their loan disbursements.

The slow growth comes mainly from state-owned banks, which have become more stringent on their loan disbursements.

State budget to receive $216m in cash dividend from State-owned businesses

Insurer Bao Viet Holdings (BVH) and the Bank for Investment and Development of Viet Nam (BIDV) have approved plans of paying cash dividends worth combined US$236 million in the next two months.

Insurer Bao Viet Holdings (BVH) and the Bank for Investment and Development of Viet Nam (BIDV) have approved plans of paying cash dividends worth combined US$236 million in the next two months.

BIDV sells 603 million shares to KEB Hana Bank

After the issuance, the bank's charter capital has increased by VND6 trillion from VNĐ34.2 trillion to more than VND40.2 trillion.

After the issuance, the bank's charter capital has increased by VND6 trillion from VNĐ34.2 trillion to more than VND40.2 trillion.

Vietnamese banks ranked among 500 strongest in region

The Asian Banker continues to honour the 500 strongest banks in the Asia-Pacific in 2019 with some familiar names from Vietnam.

The Asian Banker continues to honour the 500 strongest banks in the Asia-Pacific in 2019 with some familiar names from Vietnam.

Local banks need to build on 1H results

Local banks posted notable results in the first half but a good second half is not a given.

Local banks posted notable results in the first half but a good second half is not a given.

SOE equitisation lists fizzle up M&A

Following a muted 2018 and first half of 2019, experts are pining for a new surge in state divestments and equitisations, buoyed by new regulatory frameworks.

Following a muted 2018 and first half of 2019, experts are pining for a new surge in state divestments and equitisations, buoyed by new regulatory frameworks.

BIDV, Vietcombank, and Vietinbank amass nearly $2 billion in bad debts

Growing bad debts reaching hundreds of millions of US dollars keep pressuring BIDV, Vietcombank, and VietinBank.

Growing bad debts reaching hundreds of millions of US dollars keep pressuring BIDV, Vietcombank, and VietinBank.

Good short-term effects for Vietnam after Fed's rate cut

The US Federal Reserve’s latest rate cut will benefit commodity and equity markets in the short term, according to specialist Nguyen Tri Hieu.

The US Federal Reserve’s latest rate cut will benefit commodity and equity markets in the short term, according to specialist Nguyen Tri Hieu.

VN banks make big profits but share prices fall

Despite good business results, 11 out of 17 listed commercial banks saw share prices decrease in the first half of the year.

Despite good business results, 11 out of 17 listed commercial banks saw share prices decrease in the first half of the year.

BIDV sells 15 percent stake to RoK’s KEB Hana Bank

The Bank for Investment and Development of Vietnam (BIDV) will float more than 603 million new shares, or 15 percent of its stake to the Republic of Korea’s KEB Hana Bank.

The Bank for Investment and Development of Vietnam (BIDV) will float more than 603 million new shares, or 15 percent of its stake to the Republic of Korea’s KEB Hana Bank.

Former BIDV chairman Tran Bac Ha dies in prison

Former Chairman of the Bank for Investment and Development of Vietnam (BIDV) Tran Bac Ha died on Thursday at the age of 63 after a long illness.

Former Chairman of the Bank for Investment and Development of Vietnam (BIDV) Tran Bac Ha died on Thursday at the age of 63 after a long illness.

Credit growth expanded 7.33 percent in H1

The banking sector reported a credit growth of 7.33 percent in the first half of this year compared to the end of 2018, Governor of the State Bank of Vietnam (SBV) Le Minh Hung said.

The banking sector reported a credit growth of 7.33 percent in the first half of this year compared to the end of 2018, Governor of the State Bank of Vietnam (SBV) Le Minh Hung said.

Vietnamese banks expect big inflow of foreign capital

Tens of trillions of VND is expected to be poured into Vietnamese banks by foreign investors in 2019 and 2020 as negotiations on many deals are running smoothly.

Tens of trillions of VND is expected to be poured into Vietnamese banks by foreign investors in 2019 and 2020 as negotiations on many deals are running smoothly.

Forex reserves reach highest level to date

The State Bank of Vietnam (SBV) obtained a large amount of foreign currencies in the first half of 2019, pushing foreign exchange reserves recorded in the period to the highest level to date.

The State Bank of Vietnam (SBV) obtained a large amount of foreign currencies in the first half of 2019, pushing foreign exchange reserves recorded in the period to the highest level to date.

Forbes Global 2000 list has four Vietnamese firms

Four Vietnamese firms have been named in this year’s Global 2000 list by Forbes, an annual ranking of the world’s biggest and most powerful public companies.

Four Vietnamese firms have been named in this year’s Global 2000 list by Forbes, an annual ranking of the world’s biggest and most powerful public companies.

Bad debt handling to be audited

The handling of bad debt among credit institutions would be audited this year in order to formulate recommendations for effectively implementing a National Assembly resolution, according to the State Audit Office of Viet Nam (SAV).

Banks warned about risks associated with bond issuance

VietNamNet Bridge - Thirsty for long-term capital, many commercial banks are issuing bonds with attractive interest rates.

VN bank shares continue to lure foreign capital

VietNamNet Bridge - The stock market is still seeing foreign investors pour money into bank shares, analysts say.

‘Big four’ banks stay firmly in their positions as other big banks arrive

VietNamNet Bridge - The prosperity of the stock market in 2017 and the first months of 2018 has helped banks increase accumulated capital.