- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

digital banking

Update news digital banking

Surge in digital payments in Vietnam

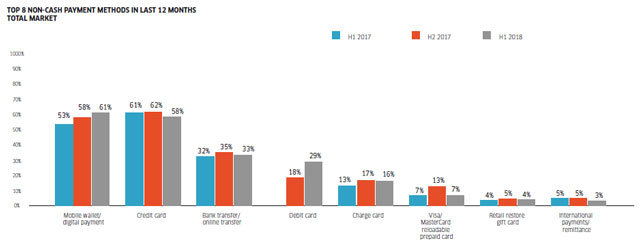

The trend towards cashless payments is experiencing rapid growth in Vietnam, driven by both card payments and QR Code transfers. This shift is supported by significant advancements in digital payment infrastructure and services.

Visa reports on the rise of Vietnam’s digital banking

Visa's report points out that, besides digital banking, digital retail has also marked particularly strong growth.

ABeam's solutions help digital banks’ business development

The competition among digital banking services is heating up in Vietnam, with the participation of not only traditional banks but also technology corporations.

Vietnam records high digital banking growth

Vietnam is one of the countries with the highest growth rates in digital banking though it is still a developing economy, according to international organizations.

Vietnam among world’s best performers in digital banking: Official

Vietnam is among the world’s best performers in digital banking, with around 15 trillion VND in total poured into digital transformation, said Le Anh Dung, Deputy Director of the State Bank of Vietnam’s Payment Department.

Vietnam needs legal framework for digital banking

The current global digitalised economy will give rise to new business models that will compete, support, or even cause traditional business models to completely shut down.

Great ambition to build digital banks in Vietnam

By 2025, Vietnam will have a generation of "digital customers". This generation has higher expectations about digital financial products and services.

Cashless society gets closer as Vietnam digital banking gathers pace

One major “side effect” of the COVID-19 pandemic, amidst the unprecedented toll that it has exacted, is that it has catalysed digital transformation across all sectors, particularly in financial services.

Vietnamese digital banking startup gets 20 million USD

According to Techinasia, Vietnam-based bank Timo has raised $20 million in an investment round led by Square Peg.

Pandemic makes 85 percent of Vietnamese consumers more likely to use digital banking in future

Around 85 percent of Vietnamese banking consumers are more likely to use online and digital banking services compared to 18 months ago, according to a new report from SaaS cloud banking platform Mambu.

Two out of five Vietnamese consumers will abandon long online banking account applications

Vietnamese consumers expect a seamless banking experience when it comes to opening an account via a mobile app or website, with two in five expecting to answer 10 questions or less or they will abandon the process.

Vietnam ‘promised land’ for digital banking

Vietnam is among the regional countries that are seeing new digital bank models, experts have said.

Transactions made via digital channels to reach 70% by 2025

The Vietnamese government will support boosting the application of new payment methods to achieve the digital transformation goals of the banking industry.

Cash payment habits change in Asia Pacific

Under the impact of the Covid-19 epidemic, the interest in new payment technologies is growing in the Asia-Pacific region.

Asia-Pacific: Vietnamese prefer digital banking the most

Vietnamese tend to be more open to digital banking services than people in other countries in the Asia-Pacific region such as Singapore, Malaysia, New Zealand or Australia, according to a recent survey by FICO.

Digital banking an option for quality human resource

The Covid-19 pandemic has severely affected almost all business and economic activities in Vietnam, and valuable and qualified human resource has taken a serious toll with several employees being laid off or having to accept large pay cuts.

Backbase report: Mobile transactions in Vietnam to grow 400 pct. by 2025

Mobile transactions in Vietnam are forecast to increase by 400 percent by 2025 in the Fintech and Digital Banking 2025 - Asia Pacific Report released by Backbase on May 11.

Mobile transactions in Vietnam are forecast to increase by 400 percent by 2025 in the Fintech and Digital Banking 2025 - Asia Pacific Report released by Backbase on May 11.

VN banks join hands with fintech to develop mobile banking apps

Allowing the "embedding" of fintech solutions into the ebanking app, banks may join the race to become "all-in-one" apps.

Allowing the "embedding" of fintech solutions into the ebanking app, banks may join the race to become "all-in-one" apps.

Electronic know your customer/client holds key to digital banking

The banking sector is waiting for the State Bank of Viet Nam to allow the use of electronic know your customer/client (e-KYC).

The banking sector is waiting for the State Bank of Viet Nam to allow the use of electronic know your customer/client (e-KYC).

Digital the only way forward

It's clear that digitalization is a prerequisite for local banks to survive and develop in the new era.

It's clear that digitalization is a prerequisite for local banks to survive and develop in the new era.