- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

investment fund

Update news investment fund

Investment funds in VN record negative performance

Many investment funds recorded large losses in 2022, but they are restructuring their portfolios, expecting long-term opportunities.

Gold prices fluctuate, traders make huge profits

The gold price in the world market has decreased by 13 percent this year, causing Vietnamese to lose billions of dollars. Meanwhile, the domestic price has stayed high.

Live video streaming startup GoStream secures 7-digit funding

GoStream, a fast-growing Vietnamese startup that provides multi-platform livestream broadcaster for social sellers, marketers, and content creators, has announced that it has secured a 7-digit USD funding from VinaCapital Ventures.

Investment funds change strategies

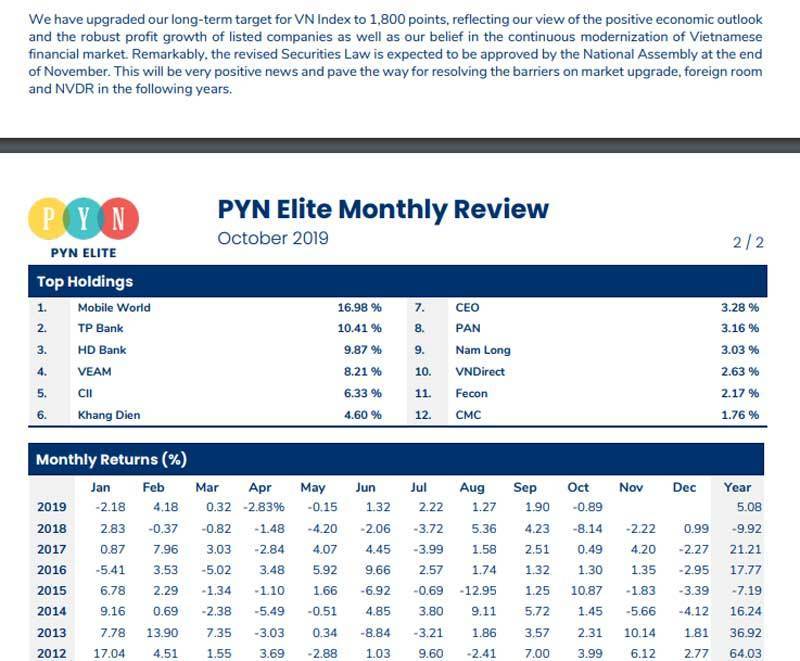

Following a volatile 2018 which witnessed the US-China trade war, the stock market in 2019 was gloomy with the VN Index hovering around 900-1,000 points.

Following a volatile 2018 which witnessed the US-China trade war, the stock market in 2019 was gloomy with the VN Index hovering around 900-1,000 points.

S.Korea’s SK Group sets up US$860-million investment fund in Vietnam

Both SK Group and South Korea’s National Pension Service (NPS) would contribute US$430 million to the fund.

Both SK Group and South Korea’s National Pension Service (NPS) would contribute US$430 million to the fund.

Foreign funds inject money into Vietnam’s businesses

Just over the last two years, about 10 billion dollars from the region have been poured into Vietnam’s leading corporations.

Just over the last two years, about 10 billion dollars from the region have been poured into Vietnam’s leading corporations.

Regulatory void makes it difficult for Vietnam's start-ups to access capital

In the absence of suitable legal framework, Vietnamese start-ups are struggling to secure much-needed capital while investment funds have difficulties navigating the country’s numerous regulatory barriers, said fund managers and policy researchers.

In the absence of suitable legal framework, Vietnamese start-ups are struggling to secure much-needed capital while investment funds have difficulties navigating the country’s numerous regulatory barriers, said fund managers and policy researchers.

Vietnam needs investment funds that back M&As

VietNamNet Bridge - The total value of M&A deals reached $6 billion in 2017, a surprisingly high figure.

Foreign investment funds making huge profits in Vietnam

Some foreign funds are leaving Vietnam after making huge profits from their investment deals, while others are entering the country to seek new opportunities.

Difficulties in getting capital hinders startup sector

VietNamNet Bridge - In 2016, total investment value in startups in SE Asia reached $1.5 billion, but less than $100 million was poured into Vietnam.

More investment funds receive licenses as stock market thrives

The Thien Viet Fund Management Company (TVAM) of Thien Viet Securities (TVS) on July 28 organized a ceremony to celebrate the first anniversary of the TVGF fund, where it announced the establishment of the second TVGF - TVGF2 fund.

Capital from Asia flowing into Vietnam’s property market

VietNamNet Bridge - Over the past year, capital flows from Japan, Singapore and South Korea have been heading for the Vietnamese market.

Assets of foreign investment funds decline on VN Index drop

Many foreign investment funds have seen their assets fall considerably since September 2014, following the stock index plunge after the drop in global oil prices and a new government regulation that tightens lending for securities investments.

What do fund management companies live on?

Only a few of the 50 existing investment fund management companies has been performing well, while others cannot raise funds to manage.

Vietnam’s stock market to prosper in 2013: analysts

Analysts all keep optimistic when giving predictions about the stock market performance in 2013 after several years of staying gloomy.

Private investment funds returning to Vietnam

The investment deal of US$200 million in Vietnamese Masan Consumer Group which has just been announced by Kohlberg Kravis Roberts (KKR) is believed to trigger a new wave of private investment funds returning to Vietnam.

Foreign capital flows out ‘cause investors’ hope exhausts

VietNamNet Bridge – Foreign businesses have withdrawn investment capital and stopped pouring money into the real estate market without any statements about the plans to come back to the market.

BUSINESS IN BRIEF 8/12

Open bidding for Metro line 2 in first quarter 2013; Government to apply new minimum wage rates; Leading firms pessimistic about new year prospects; Car import stays low at festive time