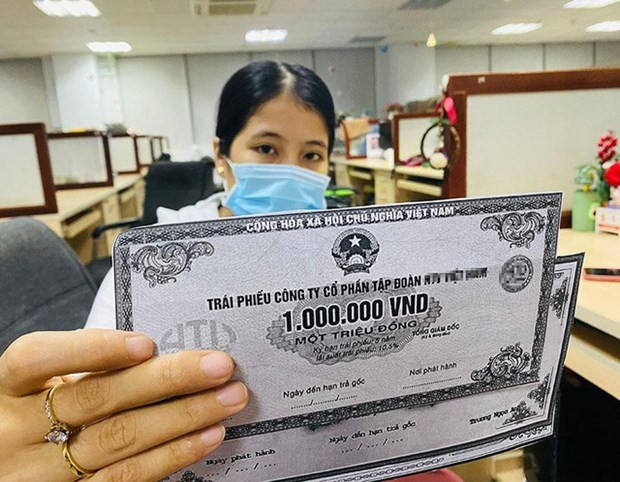

A total of 420 private placements of corporate bonds worth approximately 244.6 trillion VND (10.43 billion USD) were made in 2022, accounting for 96% of the total issuance value and marking a year-on-year decrease of 66 %, according to Vietnam Bond Market Association (VBMA).

In 2022, the banking group was the largest issuer of private corporate bonds with a value of VND 136.77 trillion VND, accounting for 53.6% of the total issuance value.

The average issuance term of this group is 5.47 years, and the average annual interest rate 5.48%.

The real estate group was the runner-up with an issuance value of nearly 52 trillion VND, accounting for 20.4% of the total issuance value. Compared to 2021, the value of bonds issued by real estate businesses decreased by nearly 76%.

In 2022, businesses bought back 210.83 trillion VND, an increase of 46% compared to 2021.

In 2023, about 290 trillion VND of bonds will reach maturity. Particularly, in the first month of the year, about VND 17.5 trillion VND of bonds get matured including 10.5 trillion VND of real estate bonds, accounting for 60% of corporate bonds’ value and 5.9 trillion VND of construction bonds, accounting for 34%.

According to VBMA, in the first week of 2023, no corporate bond placements were recorded. The total value of bonds bought back by bond issuers before maturity was 310 billion VND, down 17% compared to the same period last year.

Wood and wooden product exports projected to rake in 25 billion USD by 2030

Vietnam expects to earn 25 billion USD from the export of wood and wooden products by 2030.

The export turnover would set a record high of 18 billion USD by 2023, with wood pellets and woodchips forecast to enter the one-billion USD club.

President of the Vietnam Timber & Forest Products Association (Viforest) Do Xuan Lap said that the figure will represent a growth rate of 7-9%.

To that end, the industry will focus on raising the competitiveness of enterprises by reducing the use of imported wood, applying scientific and technological advances in improving labour productivity, and stepping up digital transformation to cut production costs.

The export of wood and forestry products was valued at 16.92 billion USD last year, surpassing the set target by 3.8%, and up 6.1% year-on-year.

To boost the export, the Ministry of Agriculture and Rural Development will propose the Prime Minister and the Government approve relevant policies, such as the national forestry planning scheme for 2021-2030 with a vision towards 2050.

Importers, especially those from major markets like the US and Europe, have intensified their technical barriers and product origin tracing, the ministry said, suggesting businesses satisfy requirements of partners to optimise advantages generated by free trade agreements in order to achieve the above-said targets.

New power generation sources proves scant

Diversifying power sources to feed the national grid has become imperative as the majority of power comes from hydropower plants, which are at the mercy of climate conditions.

In light of Decision 2976/QD-BCT dated December 30, 2022 approving Vietnam’s power system supply and operation plan in 2023, of nearly 4,300MW of new power sources be supplemented to the power grid in the new year, there are only two large-scale power plants: Thai Binh II thermos-power plant encompassing two turbines with a combined capacity of 1,200MW and BOT Van Phong thermos-power plant encompassing two turbines with a combined capacity reaching 1,432MW.

The remainder are mostly hydropower plants with a combined capacity of nearly 1,700MW, and one waste-to-power plant with 30MW annual capacity.

In 2022, out of 3,407MW of new power sources to be added throughout the year, there were just three coal-fired power turbine groups with a total combined capacity approximating 2,000MW, the remainder are all small to medium-size hydropower plants.

The power sources structure reflects lack of diversity at new power generation projects, with a large proportion of power to be mobilised from hydropower plants.

Currently, about 4,500MW in the national power system is sourced from small-size hydropower plants, yet raising power from this source is very erratic due to weather conditions.

One surprising point is that according to the power operation plan for 2020 to 2023, there are no new power sources to be expedited by state-owned power authority Electricity of Vietnam (EVN).

This would pose a threat to the system as currently EVN is deemed the key player in ensuring continuous power supply in the country.

Another concern is that despite high hope placed on the part of equity capital and foreign investment sources, no positive signs are in place for a string of such projects that had their investment proposals approved years ago to get off the drawing board.

For instance, despite receiving its investment licence back in January 2020 the LNG Bac Lieu gas-fired power project has faced many bottlenecks during the negotiation process. Though relevant proposals have been sent to the PM’s special task force years ago, no remedy is on the horizon.

Similarly, the LNG Nhon Trach 3&4 combined-cycle power projects have also yet to find a way out of power purchase agreement negotiations.

LNG Bac Lieu, LNG Nhon Trach 3&4 are some of a total 16 LNG power projects with a combined capacity reaching 23,900MW in the Power Development Plans VII (PDP 7) and amended PDP 7 that have faced impediments in power purchase agreement and capital arrangement negotiation.

Steel prices soar close to Lunar New Year holiday

Domestic steel prices have picked up after a long time of staying high, reported the local media.

Each ton of steel now exceeds VND15 million, up VND200,000 compared to a week ago, but down over VND3 million against its peak in May 2021.

The Hoa Phat steelmaker announced its second price hike in the first month of 2023 three days ago with a rise of VND200,000 for each ton of rolled steel CB240, making every ton of construction steel of this corporation amount to VND14.94 million in the north and VND14.91 million in the central region.

Similarly, each ton of construction steel at steelmakers such as Thai Nguyen, Viet Nhat and Viet Y increased by VND200,000.

Plain steel CB240 and rebar CB300, CB400 and CB500 of Thai Nguyen steelmaker were adjusted up from January 12, at over VND15 million excluding value added tax (VAT). Specifically, plain steel CB240 was increased at VND15.4 million each ton, rebar CB300 at VND15.75 million, and CB400 ranging from VND15.45-15.65 million, subject to its diameter.

Meanwhile, Viet Duc steelmaker recorded the highest price hike this time at VND210,000 per ton, resulting in an increase of rolled steel CB240 and rebar CB200 D10 at VND14.7 million and VND14.9 million, respectively (exclusive of VAT).

According to VNDirect, local steelmakers are still facing hardships in the first half of this year due to a plunge in construction demand and an increase in input material prices. However, the domestic steel industry is expected to rebound in the second half, resulting from the country’s increased public investment disbursement and China’s reopening.

Tet product fair opens in HCM City

The Green Tet – Vietnamese Gifts Spring Fair 2023 opened at 12 Phung Khac Khoan, Da Kao Ward, District 1 in HCM City on Saturday, featuring thousands of products for Tet (Lunar New Year) of 60 enterprises, production facilities and craft villages across the country.

Organised by the High Quality Vietnamese Product Business Association, the Business Studies and Assistance Centre, and the Leading Business Club, the fair is a special edition of the Green - Nice Market held on Saturdays and Sundays each week at 135A Pasteur, District 3.

Coming to the fair, customers can easily find a wide range of products such as fruits and vegetables, confectionery, honey, coconut blossom sugar, herbal teas, bio incense sticks, and specialty products of Tra Vinh, Dong Thap, Ha Giang, and other localities.

All products on sale at the fair have clear origins and meet Vietnamese and international quality standards, according to Vu Kim Hanh, chairwoman of the High Quality Vietnamese Product Business Association.

Open until January 18, the fair includes many activities such as instructing visitors to cook Tet dishes of different regions by artisans, activities that enable visitors to experience regional ethnic culture, calligraphers giving away meaningful words written in calligraphy, and a nightly lucky draw programme.

The fair is being held to support start-ups, traditional craft villages and businesses nationwide to showcase their products in the city, meeting consumer demand for farm produce and specialty products for the Lunar New Year, Hanh said.

At the opening ceremony, the organisers presented 30 gifts to underprivileged families in District 1’s Da Kao Ward.

Economists cautious on interest rate adjustments

As Vietnam’s government has raised its inflation target to 4.5 per cent for 2023, policymakers are required to maintain a cautious stance on monetary policy.

Entering 2023, inflation has emerged as the top concern for the Central Bank of Vietnam (SBV). Specifically, inflation was predicted to be above 5 per cent within January. As China’s economy is now fully open, global pricing remains unpredictable, while the US Federal Reserve is still on a path of raising and modifying interest rates.

“Thus, the SBV is under pressure to implement suitable monetary policies,” said banking expert Nguyen Chi Hieu.

BIDV chief economist Can Van Luc also said, “Amid the global economic downturn, some countries may fall into a short-term recession. In this context, Vietnam’s GDP growth is expected to slow in 2023 compared with the high base level of 2022.”

However, the country maintains a good level of GDP growth at 6-6.5 per cent as a base scenario, Luc said. Exports are expected to rise by 8-10 per cent, while domestic and foreign investment is expected to rise by about 8 per cent.

He added that the average consumer price index (CPI) is forecasted to increase to 4-4.5 per cent in 2023 from 3.3 per cent in 2022 due to a lag caused by large imports and a larger seasonal money supply by the end of 2022.

There is also an increase in some items managed by the government this year, including basic salaries, electricity prices, healthcare, and education expenses. Thus, an increase in interest and exchange rates creates mounting pressure for macroeconomic management, including monetary policy.

Unlike other countries, which had to raise interest rates to reduce inflation, Vietnam’s central bank in 2022 didn’t face inflationary pressures on interest rate management but rather exchange-rate pressure, which stemmed from the strengthening of USD globally due to the Fed’s aggressive interest rate hikes and the weakening of other major currencies, according to a Maybank Investment Bank report released in January.

The report predicted that in the first half of 2023, the SBV will likely maintain a cautious stance while monitoring CPI movement. By mid-year, when inflation is expected to be maintained at benign levels, the government will shift to easing policies, including lowering interest rates and giving more credit growth quotas to commercial banks. This will essentially form a moderate cyclical downturn scenario.

“In the event inflation rises above 5 per cent and persists through to July-August 2023, this will likely reduce the room for the central bank to ease monetary policy. As such, interest rates will probably remain at higher levels for longer, resulting in a longer cyclical downturn,” the report said.

Likewise, a report released by VNDIRECT Securities Corporation in November 2022 forecast that the SBV would maintain tight monetary policy during the 2023-2024 fiscal year due to ongoing macro uncertainties, including internal headwinds relating to property and corporate bond markets, a hawkish US Fed putting pressure on the exchange rate and surging interest rates and inflationary pressure.

As the last central bank in ASEAN to move, the SBV has been playing catch up, hiking rates by 200 basis points (bps) in 2022, Liu added.

According to Pham Chi Quang, director general of the Monetary Policy Department at the SBV, there is a huge risk of recession in 2023, especially for Vietnam’s large trading partners.

He noted that more challenges await the SBV to handle monetary policy, interest rates, exchange rates, and credit growth in 2023. However, the central bank will likely implement monetary policy with a view to controlling inflation and maintaining macroeconomic stability.

M&A helps real estate companies to raise more capital

Merger and acquisition (M&A) has become an effective capital mobilization channel for property developers in recent years.

When commercial banks moved to tighten credit flows into real estate and the capital market (bonds and securities) faced many difficulties, many real estate companies thus find merger and acquisition (M&A) can help them mobilize money.

The M&A market in Vietnam in 2022 decreased sharply compared to the previous year; specifically, in the first 10 months of 2022, it decreased by 35.3 percent compared to the same period in 2021. However, deals in the real estate sector still recorded the highest value in the past 5 years.

The big deals can be mentioned such as a domestic real estate company acquiring Capital Place - a Grade A office building located in the center of Hanoi, worth US$550 million or an M&A deal between Novaland Group and Tai Nguyen Construction, Production and Trading Company worth $1 billion.

Besides, the famous M&A deals with the participation of foreign enterprises in 2022 were US private equity fund Warburg Pincus investing US$250 million in Novaland's Tropicana resort; plus, two investment funds VinaCapital and Dragon Capital's announcement to pour $103 million into Hung Thinh Land.

Many experts believe that in 2023, amid the central bank’s tight money policy, the corporate bond market cannot immediately deal with internal problems and the stock market still cannot increase strongly, M&A will still be a channel to provide capital that real estate businesses will aim for in the near future.

Ms. Duong Thuy Dung, Senior Director of CBRE Vietnam, said that joint venture, association and cooperation with foreign partners is a new trend in domestic real estate enterprises, instead of depending on bank loans or issuing bonds. Along with that, the association with financially strong companies with good experience in project development will help domestic enterprises improve their capacity to develop projects and attract new customers.

According to Mr. David Jackson, General Director of Colliers Vietnam Real Estate Services Company, M&A activities will help rescue domestic developers. Moreover, foreign investors also want to pour money into Vietnam's real estate market as they believe in the potential of the market.

Deputy General Director of KPMG Vietnam Nguyen Cong Ai said that the real estate market will remain relatively quiet, but this is an opportunity for investors with cash to buy attractive projects. Senior Director of Savills Vietnam Group Su Ngoc Khuong also assessed that, in 2023, the capital demand for real estate projects is very huge, accompanied by rapid urbanization, which will make the M&A deals light up the property market.

Along with that, the Law on Land, the Law on Housing, the Law on Real Estate Business, and the Law on Bidding will be amended and supplemented with many major changes. With the increasingly perfect legal environment, the real estate market is expected to welcome large M&A deals.

Modest bank growth projected this year

Last year saw major changes in the banking industry, with total assets of the commercial bank group growing strongly, and most banks entering the race to diversify services. In 2023, challenges lie ahead in the context of a downturn in the real estate cycle and a less positive outlook for exports.

Vietcombank was the first bank with equity exceeding $4.26 billion by the end of 2021. In 2022, four more banks achieved this figure – Techcombank, Vietinbank, VPBank, and BIDV.

In 2022, the charter capital of many banks saw a significant increase, with some banks even recording a vast increase in charter capital. At the same time, banks continue to improve their capital adequacy ratio and apply international standards in risk management. More than 20 banks have applied Basel II standards. Notably, many banks have successfully applied Basel III with more stringent requirements, such as TPBank, ACB, VPBank, SeABank, NamABank, and OCB.

Some banks are also partially applying or piloting Basel III implementation, including VIB, HDBank, Techcombank, ABBank, MSB, and Sacombank.

Besides the growth in scale, banks’ development in customer base is significantly greater, with digital transformation being an indispensable factor. While in the past, it typically took a traditional bank 20-30 years to acquire a million customers or more, digital banks today grow in a much higher speed. An example would be Cake by VPbank, with 2.3 million customers within 20 months.

According to a report by the State Bank of Vietnam released in December, in the previous 11 months of 2022, non-cash payment transactions recorded a growth of 85.6 per cent in quantity and 31.39 per cent in value. Among this, transactions via mobile phone increased by 116.1 per cent and 92.3 per cent in quantity and value, respectively; transactions via QR code increased 182.5 per cent and 210.6 per cent respectively.

In 2022, Vietcombank, MB, HDBank, and VPBank have revealed their intentions or plans to receive a forced transfer of weak credit institutions. In which, in their April annual meeting of shareholders, Vietcombank and MB approved the plan to receive the compulsory transfer of weak banks.

By August, HDBank had also consulted shareholders and approved a plan to receive compulsory transfer.

Although VPBank has not announced a specific plan, at the annual meeting of shareholders, president Ngo Chi Dung also revealed a plan for a possible merger or acquisition.

In a newly-released strategic investment report for 2023, Rong Viet Securities Company (VDSC) believes that the banking industry will continue to weather the storm in the downtrend of real estate and a less positive outlook for import and export. According to the report, interest income growth of the banking industry will slow down due to the impact of credit growth along with a decrease in interest margin (NIM) in 2023. Credit growth is expected at 11 -12 per cent, lower than the target of 15.5-16 per cent for 2022.

Credit growth will vary among banks based on their specific advantages and level of economic support. In addition, with the negative outlook of the real estate market, credit demand is forecasted to be lower than in the past.

The decline in NIM also see a divergence among different groups, leading to the expected interest income growth below 11 per cent. Therefore, VDSC believes that interest income of banks will slow down in 2023.

Asset investment (including bonds) is also forecasted to decrease in size and profit margin, as the upcoming issuance volume may increase again compared to 2022 but still lower than the previous boom of 2019-2021, due to tight conditions. Elevated professional investor standards also make it difficult for banks to find buyers.

Growth in bancassurance income will continue to slow down, on the background of lower expected credit growth, reallocation of personal assets to high-interest savings channels, and market saturation. Some exceptions may be LienVietPostBank or HDBank, thanks to the recognition of exclusive fees and the collection of insurance premiums in the first year when signing new exclusive contracts for insurance distribution.

VDSC forecasts that the total operating income of the banking industry will grow modestly, in the context of decelerating lending activities, at 10 per cent on-year, when interest income growth is at 11 per cent. Likewise VNDirect Research’s latest report for 2023 also predicts the industry’s profit growth to decelerate and reach 10-11 per cent on-year in 2023-2024 (from 32 per cent in 2022) as credit growth usage slows, NIM shrinks, and credit costs rise.

However, the report assessed that the banking system has improved much more than before, and the banking sector remains the biggest beneficiary of Vietnam’s economic growth in the long term. “Given the current situation, we give priorities to banks that are able to defend against fluctuations such as VCB and ACB. However, once the storm is over, we have a preference for banks with low valuations, a solid capital buffer and a large proportion of real estate loans and corporate bonds in the credit portfolio, typically TCB and VPB.”

Haiphong navigational fairway to be upgraded

The Ministry of Transport has given Gemadept the green light to study the upgrade of the Haiphong navigational fairway, reported by the local media.

In an official dispatch to Haiphong City, the Vietnam Maritime Administration and Gemadept, the Transport Ministry gave in-principle approval to Gemadept to research the possibility of upgrading the Haiphong fairway section from the turning basin of the Haiphong International Container Terminal to the Dinh Vu Port.

Gemadept was requested to strictly coordinate with the Vietnam Maritime Administration, the Haiphong Department of Transport and relevant authorities to receive support and guidance during the implementation.

Along with Saigon Port, the Haiphong seaport system is one of Vietnam’s largest under the Government’s upgrade scheme.

Hanoi takes bold move to become manufacturing hub

Hanoi, in 2023, will kick start the construction of 34 new industrial parks whose plans were approved in 2018-2020 as part of efforts to make the city a manufacturing hub in the region.

To make the goal possible, the city will enhance the efficiency of 70 existing ones.

Accordingly, the development of industrial parks, power plants, and logistic hubs will be included in the city's master plan to have a proper policy for all, according to the municipal Department of Industry and Trade.

In this regard, the local authorities will facilitate the growth of key and ancillary industries, assisting local companies' operations and attracting large-cap investors to major industrial projects.

Meanwhile, the city will speed up infrastructure and ensure sufficient power supply in industrial parks.

In addition, relevant agencies will boost trade promotion and take advantage of existing free trade agreements while exploring additional markets for highly competitive products, particularly those that account for a large proportion of Hanoi's total exports.

In 2023, the Hanoi Department of Industry and Trade will help local enterprises increase their exports and strengthen their presence in the domestic market. It will also undertake measures to stabilize market prices and supplies, control the quality of products and services, and promote e-commerce platforms to meet consumer demand during the Lunar New Year or Tet.

MoIT prioritises developing domestic supply chains and stabilising prices

The Ministry of Industry and Trade (MoIT) this year will give priority to developing supply chains of domestic consumer goods and continue to stabilise commodity prices.

Deputy Minister of Industry and Trade Do Thang Hai said at present, the MoIT is promoting the implementation of solutions to ensure the balance of supply and demand and stabilise the market of essential goods for the Lunar New Year of 2023.

At the same time, it will coordinate with localities to implement market stabilisation programmes to meet people's needs during the peak of the Lunar New Year (Tet).

For the development of the domestic market, Tran Duy Dong, director of MoIT's Domestic Market Department, said that the draft on restructuring the industry and trade industry sets the target to restructure the domestic market towards fast and sustainable development.

In addition, the sector will maintain a seamless connection with import and export markets to ensure the smooth operation of domestic manufacturing activities.

Based on expanding the domestic consumption market, together with the development of Vietnamese brands, the sector will exploit the advantages of the rapid growth of the middle class and young and dynamic consumers.

Accordingly, the ministry will prioritise the development of new consumer economic models such as sharing economy, night-time economy, tourism economy, green economy, circular economy, digital economy, and e-commerce.

It expects that the added value of domestic trade will achieve an average growth rate of about 9-9.5 per cent each year.

In addition, the industry and trade sector will build and develop a synchronous and modern commercial infrastructure system and prioritise modernising the distribution system in rural and mountainous areas. It will encourage enterprises, commercial cooperatives and business households to innovate their operation methods according to modern and professional manners.

The ministries will manage the quality of goods circulating on the domestic market under international regulations and standards, and implement product and goods traceability. In addition, they also coordinate with localities to develop domestic consumer goods supply chains, especially for agricultural products and food.

The MoIT sets a goal that by 2030, goods distributed via the modern retail system will account for about 38-42 per cent, while those sold via e-commerce channels account for about 10.5-11 per cent.

The domestic sector is targeted to account for 85 per cent of Viet Nam's total retail sales of goods. In comparison, the foreign-invested sector will account for about 15 per cent.

According to MoIT, in 2022, Viet Nam controlled the COVID-19 pandemic, so production activities and people's daily life gradually recovered, and the demand for goods increased again.

The domestic supply of goods met the demand, while commodity prices did not have large fluctuations.

Concerning petroleum products, the ministry has carried out many solutions to ensure supply, limiting the impact of fuel price hike.

The ministry reported the prices of many goods on the domestic market tended to increase from the end of the first quarter of 2022.

In the second quarter, the price of input materials rose due to the increase in the price of raw materials on the world market.

However, from the beginning of the third quarter, following the trend of world prices, prices of many commodities have gradually stabilised again.

The General Statistics Office reported that in 2022, the national retail sales of goods and services were estimated at VND5.7 quadrillion, up 19.8 per cent over the previous year. This was a fairly high growth rate in recent years.

Nearly 4,000 traverse Mong Cai int’l border gate

Nearly 4,000 people have undergone immigration procedures via Mong Cai international border gate in the northern province of Quang Ninh in 10 days after resuming entry-exit regulations.

As many as 3,530 of those were Chinese who left Vietnam for home, reported the gate’s management board on January 17.

From January 1-16, more than 4,200 people applied for entry-exit procedures, including 417 entering and 3,793 leaving Vietnam, most of them were Chinese returning home after three years of staying in Vietnam due to the COVID-19 pandemic.

Entry-exit activities take place at Mong Cai international border gate from 8am to 4pm (Hanoi time) daily. Travellers must hold passports and have negative RT-PCR test papers valid within 48 hours.

From January 8-16, trade volume between Vietnam and China reached over 36,600 tonnes. Of the figure, more than 15,000 tonnes was recorded at Bac Luan II Bridge border gate.

From January 1-16, the figure stood at over 64,400 tonnes at Mong Cai international border gate, including more than 26,700 tonnes carried by 1,696 vehicles at the Bac Luan II Bridge border gate.

Banking fraud surges ahead of Tet

As Vietnamese often go on a shopping spree during the Lunar New Year holiday, banking fraud is also on the rise.

Fraudsters often pose as representatives of well-known businesses such as banks and send their target victims text messages, deceiving them into clicking an attached link and revealing their personal or financial information.

Tien Phong Commercial Joint Stock Bank said there were cases of criminals pretending to be bank tellers and contacting their clients via social media platforms such as Zalo, Facebook and Instagram, luring them into using their loan services and disclosing their personal information.

Thus, the bank has warned its clients about the scheme, asking them not to reveal personal information and passwords to log in to banking services or an OTP to anyone.

The allocated amount doubles the 2022 level.

The majority of the capital will be invested in transport infrastructure works such as the construction project of the An Phu intersection (600 billion VND), the expansion project of National Highway 50 in Binh Chanh district (184 billion VND), the component No1 project of Ring Road 3 (1 trillion VND) and Ben Thanh-Suoi Tien urban railway project's metro line No1 (779.6 billion VND).

The city's authorities are determined to adopt changes so that the disbursement rate of public investments in 2023 reaches more than 95%.

Vietnam-Australia trade hits record high in 2022

Two-way trade between Vietnam and Australia enjoyed a record year-on-year growth of 26.91% to 15.7 billion USD in 2022, according to the Vietnam Trade Office in Australia.

Vietnam’s export turnover to Australia last year expanded 26.18% year-on-year to 5.55 billion USD while its imports were valued at 10.14 billion USD, an increase of 27.31%.

Data from the office shows that many key exports of Vietnam continue to post high growth amid various challenges, including machinery, equipment, tools, and other spare parts (62.1%); footwear (41.3%); textiles (26.3%); aquatic products (37.3%); iron and steel (102.9%); handbags, suitcases and umbrellas (24.8%); coffee (62.53%); and electric wires and cables (81.2%).

Meanwhile, Australia continued to be an important supplier of raw materials for Vietnam’s production of coal, cotton, ores and other minerals, and wheat.

Head of the trade office Nguyen Phu Hoa said that the industry structure of Vietnam and Australia are complementary to each other, helping the two economies enhance their advantages instead of competing.

Last year, the bilateral trade goals were achieved quickly, he said, adding that Vietnam has become Australia's 10th largest trade partner for the first time, while Australia is now Vietnam's 7th largest trade partner.

Economic experts say that there is a great room for Vietnam and Australia to promote trade growth. The implementation of free trade agreements, including the ASEAN-Australia-New Zealand Free Trade Agreement (AANFTA), the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP), offer opportunities for further cooperation between the two countries.

This year, the Vietnam Trade Office in Australia plans to implement promotion programmes for industries with large turnover and follows the directions of the Ministry of Industry and Trade in expanding the Vietnamese imports and exports.

Buon Ma Thuot strives to become world’s coffee city

The Central Highlands province of Dak Lak – Vietnam’s largest coffee-producing region - is striving to make its capital of Buon Ma Thuot a coffee city of the world with distinctive identities.

The provincial People’s Committee has built a project on the work, developing tourism in an ecological direction, and bringing into full play local cultural values associated with national relic sites.

Vice Chairman of the People’s Committee of Buon Ma Thuot city Tran Duc Nhat said that in recent years, the locality has paid attention to urban construction management, and infrastructure upgrade.

One of the highlights of the future coffee city will be the maintenance of existing identities of 40 ethnic groups to attract visitors.

All urban functional areas and architectural works will be turned into tourist destinations, and more efforts made to attract investors and talents to work in the city, he added.

Coffee was first cultivated in Vietnam in 1857. Dubbed as the coffee capital of Vietnam, Dak Lak has the largest farming area of around 210,000 hectares with an annual output of more than 520,000 tonnes. Meanwhile, Buon Ma Thuot is home to some of the finest coffee in Vietnam.

Vietnam, S.Korea look to achieve US$100 billion in bilateral trade this year

Vietnam and South Korea strive to increase bilateral trade to US$100 billion in 2023 and US$150 billion in 2030.

Prime Minister Pham Minh Chinh had a meeting with the South Korean National Assembly’s Chairman Kim Jin Pyo during his official visit to Vietnam at the Government Office yesterday, January 17.

South Korea is now the biggest foreign investor in Vietnam with total pledged capital of US$80.5 billion.

Bilateral trade between Vietnam and South Korea in 2022 amounted to nearly US$87 billion, up by US$9 billion against last year. Vietnam had a trade deficit of US$38.3 billion with South Korea.

PM Chinh affirmed South Korea is a trusted partner and Vietnam wants to maintain a strategic and long-term relationship with South Korea.

To achieve the bilateral trade targets, the prime minister proposed the two countries cooperate effectively in implementing the Vietnam-Korea Free Trade Agreement (VKFTA) and the Regional Comprehensive Economic Partnership (RCEP).

Vietnam applauded the expansion of South Korean investment activity in Vietnam, especially in hi-tech, green economy, digital transformation, renewable energy, and smart and ecocity.

Govt approves changes to Dong Dang – Tra Linh expressway project

The Government has approved major changes to the Dong Dang – Tra Linh expressway project including scope of investment, capital structure and duration of project.

Under the revised plan, the Dong Dang – Tra Linh expressway will span 121.06 kilometers instead of 115 kilometers as previously planned, with 52 kilometers passing through Lang Son Province and 69.06 kilometers in Cao Bang Province.

To connect the expressway with Cao Bang City, the prime minister assigned the Cao Bang People’s Committee to research and invest in a separate road project.

The first phase of the project will stretch 93.35 kilometers, starting from the intersection of Tan Thanh border gate, Van Lang District, Lang Son Province to the intersection of Highway No. 3, Quang Hoa District, Cao Bang Province.

Some 27.71 kilometers of the project’s second phase will start from the endpoint of the first phase section to the boundary of the Tra Linh border gate economic zone, Trung Khanh District.

The lengthening of the expressway sent the project’s investment cost rising from VND20,939 billion to VND22,690 billion, of which VND13,174 billion will be spent on the first phase between now and 2025.

The completion of the project will be pushed back by one year compared to the previous plan.

The second phase, to be implemented after 2025, will need VND9,516 billion, sourced from the State budget, local budget and other sources of funding.

Personal income tax revenue surges 27% y-o-y

The 2022 personal income tax revenue soared 27% against the previous year, at over VND166.7 trillion, showed data of the General Statistics Office (GSO).

The figure was 38% higher than the 2022 target, equivalent to an additional revenue of VND48.6 trillion, the Vietnam News Agency reported.

Personal income tax collections have swollen in recent years, with the 2022 revenue surging 50%, or VND57 trillion, compared to 2020, and 3.5 times over 2013.

The rapid rise in personal income tax stemmed from unsuitable provisions of the personal income tax law, including low deductions for taxpayers, which led tax revenue growth to outpace employees’ income growth, the GSO said.

Source: VNA/SGT/VNS/VOV/Dtinews/SGGP/VGP/Hanoitimes