- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

vietnam's monetary policy

Update news vietnam's monetary policy

Monetary policy governance requires thorough consideration: official

As of the end of September, the economy recorded over 12.7 quadrillion VND (517.5 billion USD) in credit, up 6.92% from the end of 2022.

Businesses hoping for flexibility with lending conditions

Businesses are still up against it when it comes to applying for bank loans, even though Vietnam’s central bank has cut interest rates several times already this year.

VN central bank buys US$4 billion of currencies in Q1/2023

Amidst the global uncertainties, the Central Bank has been buying back foreign currencies to ensure an adequate trade balance and economic stability.

Fiscal policy forecast to be key driver for Vietnam’s growth in 2023

Deputy Minister of Industry and Trade Do Thang Hai said the fall in global import demand for Vietnam's strong goods would negatively impact the country's exports this year.

Vietnam’s money supply forecast to rebound in 2023

After hitting a record low in 2022, Viet Nam’s money supply (M2) will rebound in 2023 and become an important driver for the recovery of the stock market, KB Securities Vietnam (KBSV) forecast.

How the central bank can get to grips with dipping rates and economic turbulence

As global central banks begin to neutralise loosened monetary policy, such as the Fed lowering rates, this is seen as positive signals as the world economy gradually recovers, minimising the risk of global economic crisis.

US not impose tariff or sanction on Vietnam’s exports

The US Trade Representative (USTR), in its report released on January 15 on findings in the Section 301 investigation of Vietnam’s acts, policies, and practices related to currency valuation,

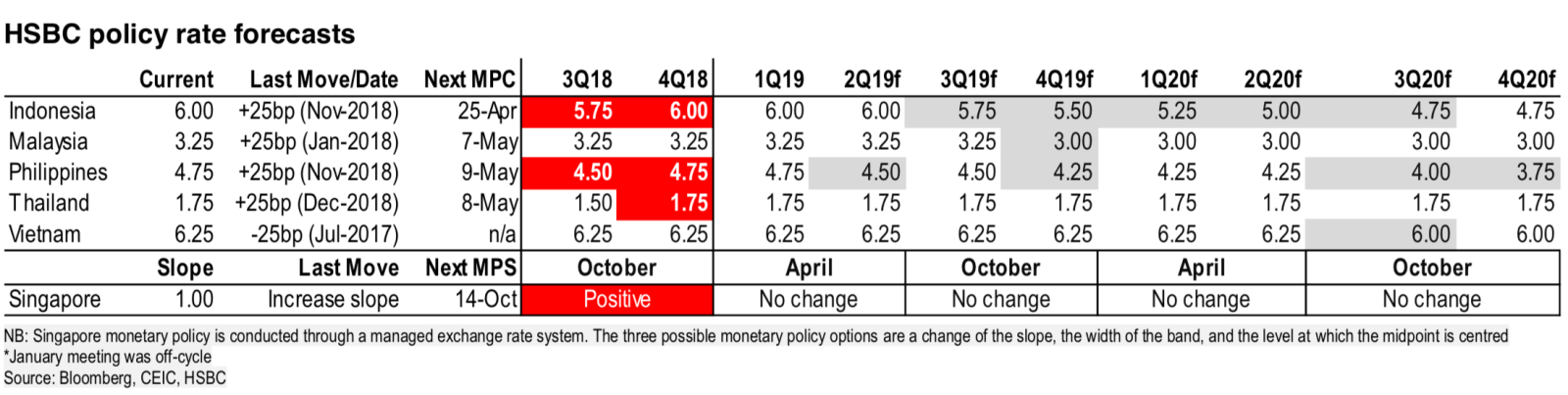

Vietnam expected to cut policy rate in second half of 2020: HSBC

The need to ease policy rates in the near-term is unlikely, given the country’s still-robust growth and heightened foreign direct investment.