- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

FDI

Update news FDI

Influx of foreign investment in property sector raises concern

The prime minister has asked several ministries, agencies and local governments to report on the risk of the domestic real estate market being dominated by foreign entities, given the recent influx of foreign investment into the sector.

The prime minister has asked several ministries, agencies and local governments to report on the risk of the domestic real estate market being dominated by foreign entities, given the recent influx of foreign investment into the sector.

Vietnamese firms pour more investments into developed countries

Vietnamese investors are increasing their investments in projects abroad, especially in developed countries, such as Australia and the United States.

Vietnamese investors are increasing their investments in projects abroad, especially in developed countries, such as Australia and the United States.

Vietnam’s economic outlook positive in medium term: WB

The medium-term outlook for the Vietnamese economy is broadly positive despite persistent downside risks, the World Bank (WB) said in its East Asia and Pacific Economic Update released on October 10.

The medium-term outlook for the Vietnamese economy is broadly positive despite persistent downside risks, the World Bank (WB) said in its East Asia and Pacific Economic Update released on October 10.

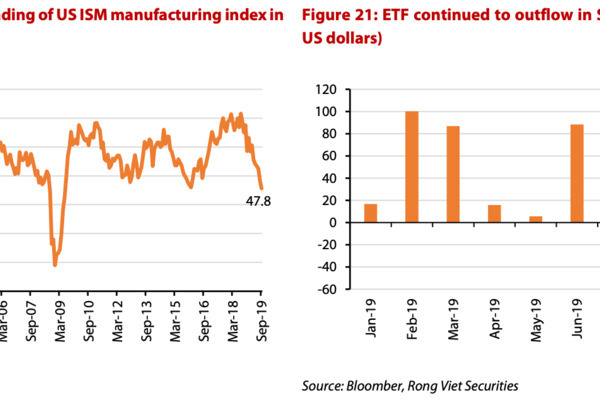

External risks weigh on foreign capital pouring into Vietnam’s stock market

Foreign investors’ trading on exchanges and net injecting/withdrawing value from the exchange-traded funds (ETFs) has a high correlation with a usual lag of one month.

Foreign investors’ trading on exchanges and net injecting/withdrawing value from the exchange-traded funds (ETFs) has a high correlation with a usual lag of one month.

Vietnam to name government agencies sluggish in disbursing ODA

Starting October 15, the Ministry of Finance is scheduled to disclose the disbursement data on a 15-day basis at http://mof.gov.vn.

Starting October 15, the Ministry of Finance is scheduled to disclose the disbursement data on a 15-day basis at http://mof.gov.vn.

Vietnam buying more materials from the US amid US-China trade war

The US-China trade war is giving opportunities to Vietnam to diversify material supply sources, increase imports from the US to reduce the trade surplus with the country, and reduce the trade deficit with China.

The US-China trade war is giving opportunities to Vietnam to diversify material supply sources, increase imports from the US to reduce the trade surplus with the country, and reduce the trade deficit with China.

Why Vietnam ranks eighth among top 20 countries to invest in

Vietnam was ranked eighth among the top 20 best countries to invest in by US News & World Report, surpassing neighbours like Malaysia, Indonesia, and Singapore.

Vietnam was ranked eighth among the top 20 best countries to invest in by US News & World Report, surpassing neighbours like Malaysia, Indonesia, and Singapore.

Vietnam’s GDP too heavily dependent on foreign-invested enterprises: economists

Commenting about the reliance of Vietnam’s economy on FIEs (foreign invested enterprises), one economist noted that “when FIEs sneeze, the Vietnamese economy catches a cold".

Commenting about the reliance of Vietnam’s economy on FIEs (foreign invested enterprises), one economist noted that “when FIEs sneeze, the Vietnamese economy catches a cold".

Industrial real estate thrives on FDI increase

Existing factors in the market, especially strong FDI inflow, all are supporting the prosperity of the industrial real estate market.

Existing factors in the market, especially strong FDI inflow, all are supporting the prosperity of the industrial real estate market.

Foreign investors keen on Vietnam’s fintech market: Banker

Many foreign investors are interested in investing in Vietnam’s fintech market that have huge growth potential, said Han Ngoc Vu, general director of VIB International Commercial Bank, at Fintech Summit 2019 held in Hanoi recently.

Many foreign investors are interested in investing in Vietnam’s fintech market that have huge growth potential, said Han Ngoc Vu, general director of VIB International Commercial Bank, at Fintech Summit 2019 held in Hanoi recently.

Vietnam’s insurance sector catches foreign attention

The Vietnamese insurance market is heating up with many high-value bancassurance deals and mergers and acquisitions (M&A) unveiled recently.

The Vietnamese insurance market is heating up with many high-value bancassurance deals and mergers and acquisitions (M&A) unveiled recently.

Vietnam considers new strategy on FDI

Southeast Asia including Vietnam have emerged as destinations for investors in the reallocation of investment flow, especially capital flow from China.

Southeast Asia including Vietnam have emerged as destinations for investors in the reallocation of investment flow, especially capital flow from China.

Reaching high for the Fortune Global 500

Vietnam is being encouraged to focus more on developing a skilled workforce, the domestic private sector, and improvement of regulations to attract companies on the Fortune Global 500 list to serve the new development era.

Vietnam is being encouraged to focus more on developing a skilled workforce, the domestic private sector, and improvement of regulations to attract companies on the Fortune Global 500 list to serve the new development era.

Slow disbursement causes concern

The slow disbursement of capital has stalled many projects, affecting socio-economic development.

The slow disbursement of capital has stalled many projects, affecting socio-economic development.

Law changes proposed to allow foreign firms to list on VN’s stock market

Vietnam is striving to improve its stock market’s status and implementing measures to attract portfolio investment, and allowing FDI firms to list would help the country achieve this goal.

Vietnam is striving to improve its stock market’s status and implementing measures to attract portfolio investment, and allowing FDI firms to list would help the country achieve this goal.

Quality FDI attraction receives resolution lift

With the Politburo’s new orientation in the policies on foreign investment attraction, government agencies and localities are hoping to stave off potential issues in order to take the appropriate actions to add to its attraction.

With the Politburo’s new orientation in the policies on foreign investment attraction, government agencies and localities are hoping to stave off potential issues in order to take the appropriate actions to add to its attraction.

Vietnam’s textile export value up almost 9% in eight months

Vietnam Textile and Apparel Association (Vitas) said the total export value of textiles, fiber, and cloth reached US$25.7 billion in the first 8 months of the year, up 8.6 per cent year on year, including 60.6 per cent from FDI enterprises.

Vietnam Textile and Apparel Association (Vitas) said the total export value of textiles, fiber, and cloth reached US$25.7 billion in the first 8 months of the year, up 8.6 per cent year on year, including 60.6 per cent from FDI enterprises.

Co-working spaces boom in Vietnam

Co-working spaces have become the choice of many startups and small and medium sized businesses.

Co-working spaces have become the choice of many startups and small and medium sized businesses.

FIEs favored while Vietnamese enterprises at a disadvantage

The problems caused by FIEs, such as transfer pricing and investment under others’ names, have been noted in the Party Politburo’s Resolution 50 for the first time.

The problems caused by FIEs, such as transfer pricing and investment under others’ names, have been noted in the Party Politburo’s Resolution 50 for the first time.

Many foreign companies move factories to Vietnam: Savills

Many companies are moving their factories from other countries to Vietnam, showing the potential for strong development of industrial real estate, according to Savills Vietnam.

Many companies are moving their factories from other countries to Vietnam, showing the potential for strong development of industrial real estate, according to Savills Vietnam.