- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

hose

Update news hose

Vietnam benchmark VN-Index set to go sideways in November

The VN-Index edged up 2% month-on-month in October to finish at 925.47 and was among the best-performers in the world.

Billions of dollars worth of shares expected to enter bourse

A number of commercial banks are going to list their shares at the HCM City Stock Exchange (HOSE), and are expected to bring a breath of fresh air to the market, which has been stagnant because of the pandemic.

How can VN stock market attract 'super' investors?

Some government officials say Vietnam needs to attract ‘eagles’, as it calls big and 'super-big' investors, to help upgrade the stock market.

Is there a new wave of bank shares landing in VN stock market?

Commercial banks have six months to fulfill procedures to list their shares on the bourse, as requested by the Prime Minister.

Commercial banks have six months to fulfill procedures to list their shares on the bourse, as requested by the Prime Minister.

Shares to correct amid lack of positive news

The benchmark VN-Index on the Ho Ch Minh Stock Exchange (HoSE) gained 0.62 per cent to close Friday at 847.61 points.

Petrolimex plans stock sale, divestment of State capital

The Vietnam National Petroleum Group (Petrolimex) plans to sell 15 million treasury stocks in transactions held between June 16 and July 15 to mobilise capital for investment in 2020,

July to be a hard month for Vietnamese shares

July looks set to be a hard month for investors as market turbulence continues due to the unpredictability of global stocks and with attention on second-quarter earnings expectations.

Foreign-invested enterprises hopeful about plans to list shares on bourse

The Ministry of Finance (MOF), suggesting solutions to help the stock market overcome the Covid-19 crisis, has once again proposed allowing foreign-invested enterprises (FIEs) to list on the bourse.

The Ministry of Finance (MOF), suggesting solutions to help the stock market overcome the Covid-19 crisis, has once again proposed allowing foreign-invested enterprises (FIEs) to list on the bourse.

UPCoM-traded firms seek ways for bourse switch

Unlisted public companies are planning to move to the Ho Chi Minh and Ha Noi stock exchanges to increase share liquidity and capital.

Vietnamese stocks to struggle with increased caution

The Vietnamese stock market is forecast to struggle this week with rising caution among investors as they wait for the market to reach its balance point.

Opportunities still exist but market will struggle to make big advance

The Vietnamese stock market may continue to maintain growth this month but momentum will be weaker than it was in May, according to brokerages.

Share set to increase, facing corrections

Vietnamese stock market is forecast to move higher this week, where correction and volatility is expected.

Vietnamese stock market is forecast to move higher this week, where correction and volatility is expected.

Market capitalisation of listed shares on HOSE drops in March

The COVID-19 pandemic has had significant impacts on the stock market, with all indexes on the Ho Chi Minh City Stock Exchange (HOSE) falling sharply in March.

The COVID-19 pandemic has had significant impacts on the stock market, with all indexes on the Ho Chi Minh City Stock Exchange (HOSE) falling sharply in March.

Singaporean firm wants to up stake in Vinamilk

Singaporean firm F&N Dairy Investment Pte Ltd has filed an offer to purchase more than 17.4 million shares in domestic dairy producer Vinamilk (HoSE: VNM).

Singaporean firm F&N Dairy Investment Pte Ltd has filed an offer to purchase more than 17.4 million shares in domestic dairy producer Vinamilk (HoSE: VNM).

Shares not ready for stable growth on concerns over persistent risks

A three-day rally does not mean Vietnamese shares have returned to the growth track as risks are still persistent and there is no clue they have faded away, experts have said.

A three-day rally does not mean Vietnamese shares have returned to the growth track as risks are still persistent and there is no clue they have faded away, experts have said.

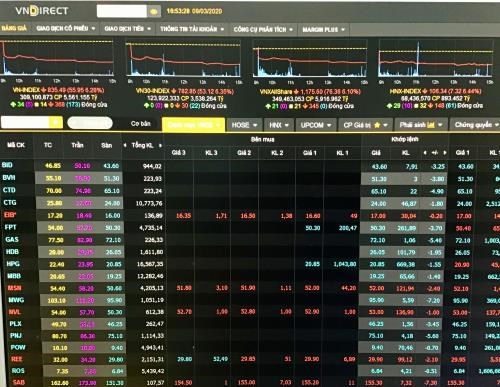

VN-Index hits rock bottom in past 18 years

The benchmark VN-Index on the Ho Chi Minh Stock Exchange (HoSE) took a nosedive to close at 835.49 points on March 9, recording the worst slump since 2002.

The benchmark VN-Index on the Ho Chi Minh Stock Exchange (HoSE) took a nosedive to close at 835.49 points on March 9, recording the worst slump since 2002.

Trading remains quiet amid risk concerns

Brokerage firms and market experts remain pessimistic about market trading this week as investors run out of supportive information while international stocks continue to be weighed down by the novel coronavirus (COVID-19).

Brokerage firms and market experts remain pessimistic about market trading this week as investors run out of supportive information while international stocks continue to be weighed down by the novel coronavirus (COVID-19).

FIEs reluctant to list shares on bourse

Only 10 foreign invested enterprises (FIEs) have entered the bourse over the last decade, a very modest figure compared with the tens of thousands of enterprises now operational in Vietnam.

Only 10 foreign invested enterprises (FIEs) have entered the bourse over the last decade, a very modest figure compared with the tens of thousands of enterprises now operational in Vietnam.

Firms ask for delay financial statements release

The Ho Chi Minh Stock Exchange (HOSE) has received dozens of documents from listed companies asking to extend the deadline for the disclosure of this year's financial statements.

The Ho Chi Minh Stock Exchange (HOSE) has received dozens of documents from listed companies asking to extend the deadline for the disclosure of this year's financial statements.

Vietnam’s stock market keeps appealing to foreign investors

The prospect of the Vietnamese stock market this year will be brighter, with profits of listed firms in 2020 likely to increase by 18% against 2019 while the VN-Index may rise by 20.7%.

The prospect of the Vietnamese stock market this year will be brighter, with profits of listed firms in 2020 likely to increase by 18% against 2019 while the VN-Index may rise by 20.7%.