- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

mobile money

Update news mobile money

Pilot Mobile Money service to be licenced next month

Local telecommunications network providers have been approved to pilot several Mobile Money services next month after more than two years of waiting. These services will allow the use of mobile phone credit to pay for small-value goods and services.

Government requests prompt trial use of Mobile Money

The Government has urged the use of non-cash payments and the deployment of Mobile Money as a solution. The service is still awaiting licensing.

Fintechs to partner with telecom carriers to offer Mobile Money

The pilot program on providing the Mobile Money service is expected to increase non-cash transactions, especially in remote areas. To improve users' experience, fintechs should work with network operators, experts say.

Mobile money attempts to topple classic banking

The newly-launched mobile money pilot programme is expected to heat up competition for domestic players but also open collaboration opportunities to cash in on the niche market.

MIC focusing on popularising Mobile Money

The successful implementation of Mobile Money is one of the major targets of the Ministry of Information and Communications (MIC).

Mobile Money to increase pressure on banks

The payment market is expected to see big changes with the appearance of Mobile Money.

Mobile Money users may be charged: authority

Customers using Mobile Money, a freshly-approved pilot project, may be charged a certain fee, according to the Vietnam Telecommunications Authority under the Ministry of Information and Communications.

Mobile Money: one decision benefits millions of people

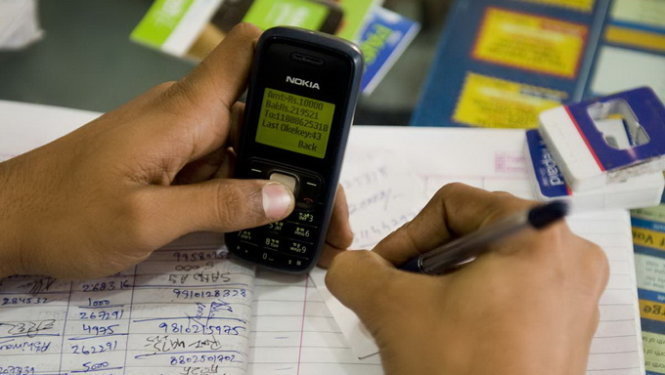

With Mobile Money, people in mountainous areas or islands can remit money and make payments for goods and services through SMS on their mobile phones.

Mobile Money paves the way for sandbox mechanism: minister

Mobile Money on a trial basis will create a precedent for applying the sandbox mechanism to other services and new professions to appear in digital society.

Vietnam banks required to issue chip cards from March 2021

As of the end of the third quarter, Vietnam has around 93.78 million bank cards in circulation, in which the majority are magnetic cards.

Mobile money regulations explained

As businesses in Vietnam race to provide financial services for the unbanked and underbanked population through various fintech solutions, the Vietnamese government is closely following this industry trend

Banks’ support desired for mobile payments

New approaches, especially regarding activities of banks, are required to boost the reach of mobile money agents and expand financial inclusion in Vietnam.

Vietnam's digital economy speeds up during pandemic

The pandemic has created big changes in society as people shop, gather and learn online, and use smartphones and TVs for entertainment more regularly.

The pandemic has created big changes in society as people shop, gather and learn online, and use smartphones and TVs for entertainment more regularly.

Cashless ecosystem now on the cards

As Vietnam heads towards a cashless economy and mobile technology is becoming ubiquitous, the adoption of mobile money next month is predicted to lure local and foreign firms into joining the game.

As Vietnam heads towards a cashless economy and mobile technology is becoming ubiquitous, the adoption of mobile money next month is predicted to lure local and foreign firms into joining the game.

Vietnam gov't greenlights Mobile Money

The regulation on mobile payment will not allow users to recharge from scratch cards but they must conduct deposits and withdrawals from the registered bank account.

The regulation on mobile payment will not allow users to recharge from scratch cards but they must conduct deposits and withdrawals from the registered bank account.

Covid-19 gives push to digital transformation process in Vietnam

The concept of digital transformation has become clearer during the Covid-19 crisis.

The concept of digital transformation has become clearer during the Covid-19 crisis.

Vietnam to launch mobile money in June

Mobile money is about to be launched in Vietnam despite worries about management methods.

Mobile money is about to be launched in Vietnam despite worries about management methods.

Mobile money to boom in Vietnam

The government of Vietnam is moving ahead with a plan to put mobile money into use to reduce social contact and cash circulation.

The government of Vietnam is moving ahead with a plan to put mobile money into use to reduce social contact and cash circulation.

Mobile money pilot project submitted to PM for approval

A mobile money pilot project has been submitted to the Prime Minister for approval, marking a bold step for the development of payments using telecommunication accounts in Vietnam, Governor of the State Bank of Vietnam Le Minh Hung said.

A mobile money pilot project has been submitted to the Prime Minister for approval, marking a bold step for the development of payments using telecommunication accounts in Vietnam, Governor of the State Bank of Vietnam Le Minh Hung said.

Mobile money project to be submitted to the Government this month

Telecommunications providers like VNPT, Viettel and MobiFone will join in the payment market.

Telecommunications providers like VNPT, Viettel and MobiFone will join in the payment market.