- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

SBV

Update news SBV

No interest rate hike in 2024: State Bank of Vietnam

The State Bank of Vietnam (SBV) will not consider increasing policy interest rates and might extend debt rescheduling policies to support enterprises this year, said SBV Deputy Governor Dao Minh Tu said at a press conference on January 3.

State does not encourage gold bar trading: VN central bank

The State does not encourage the trading of gold bars, protect their prices, nor accept too large differences between domestic and global gold prices, and between SJC and other types of gold bars.

State Bank of Vietnam to keep policy rates steady in 2024: UOB

With the pace of economic activities on the mend and inflation rates already easing below the target level, the State Bank of Vietnam (SBV) will maintain its refinancing rate at the current level of 4.5% to support economic recovery.

VN central bank pumps VND360,000 billion into market

Over VND360,000 billion earlier withdrawn by the State Bank of Vietnam (SBV), the central bank, through its issues of Treasury bills has been injected into the banking system.

Government to inspect credit growth management by central bank

The Government will conduct an inspection of credit growth management by the central bank in response to low credit growth.

State Audit recommends speeding up handling of weak banks

The State Audit of Vietnam (SAV) has recommended the State Bank of Vietnam (SBV) coordinate with agencies to urgently speed up the compulsory transfer of poor-performing banks OceanBank, GPBank, CBBank and DongA Bank.

Transactions worth VND400 million to be reported to SBV

Transactions with a value of VNĐ400 million or more must be reported to the State Bank of Vietnam (SBV) from December 1, 2023, according to a new policy.

Central bank ceases bill issue amid increasing interbank interest rates

The State Bank of Vietnam (SBV) has ceased bill issue after nearly two months of using the channel to withdraw cash out of the banking system.

Credit growth quotas still necessary, says central bank governor

Credit growth quotas remain essential for sustaining economic growth and supporting businesses and individuals, said Nguyen Thi Hong, governor of the State Bank of Vietnam (SBV).

SBV withdraws VND230 trillion, dollar price under pressure

Analysts say that the dong/dollar exchange rate is still ‘volatile’ despite the central bank’s recent strong intervention. However, the State Bank (SBV) has efficient tools to maintain the exchange rate and interest rate stability.

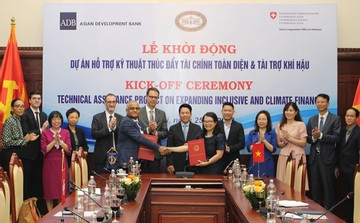

ADB, Switzerland aid fintech development in Vietnam

The Asian Development Bank and the State Bank of Vietnam held a kick-off ceremony marking the implementation of the Swiss-funded $5mil technical assistance, which aims to nurture financial technologies serving financial inclusion improvement in VN.

Monetary policy governance requires thorough consideration: official

As of the end of September, the economy recorded over 12.7 quadrillion VND (517.5 billion USD) in credit, up 6.92% from the end of 2022.

SBV to submit plan on compulsory transfer of two weak banks

The State Bank of Vietnam (SBV) is directing concerned parties to submit to the government a plan on compulsory transfer of two weak banks for approval.

SBV handles ‘circular ownership’ of banks with heavy hand

The State Bank of Vietnam (SBV), while affirming that it is working hard to settle cross ownership among banks, has complained that this is a complex process because of the lack of a reasonable mechanism, information, and tools for control.

SBV Governor warns of real estate bad debts

The leader of the State Bank of Vietnam (SBV) said that the non-performing loan ratio in the real estate sector is on the rise compared to the end of the previous year, with figures of 1.8 percent in July 2022 and 2.58 percent in July 2023.

VND90 trillion withdrawn from banking system

The State Bank of Vietnam (SBV) has withdrawn nearly VND90 trillion from the banking system through six consecutive rounds of Treasury bill auctions.

Different forecasts made for policy interest rates in the rest of 2023

Experts have different forecasts about the time when the State Bank of Vietnam (SBV) will lower its policy interest rate.

Transferring VND10 million may require biometric authentication

It is expected that biometric authentication such as fingerprint, iris, or facial recognition will be mandatory for money transfers exceeding the minimum level, possibly starting from 10 million VND (410.93 USD).

Cross-border payment will greatly benefit regional trade and tourism

The State Bank of Vietnam (SBV) has signed a Memorandum of Understanding on regional payment connectivity with their counterparts of ASEAN5 countries, namely Indonesia, Malaysia, Philippines, Singapore, and Thailand.

Anti-money laundering bureau to be granted additional autonomy and power

Anti-money laundering should receive greater operational autonomy and independence, according to the State Bank of Vietnam (SBV).