- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

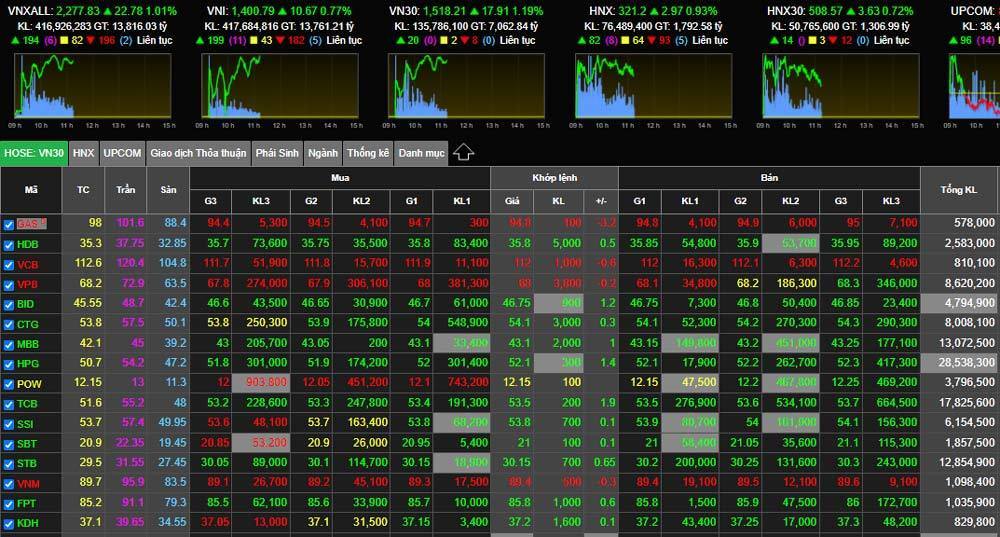

stock market

Update news stock market

Business stories: ‘Boss Duc’ regrets decision, ‘Boss Thuy’ sets records

Doan Nguyen Duc, or Boss Duc, Chair of Hoang Anh Gia Lai Group (HAG), said he regrets the decision on giving up real estate. Nguyen Duc Thuy, or Boss Thuy, has wrapped up a lot of new deals.

Stock trading booms, money flows to bankers’ pockets

Bank shares continue to attract cash flow. The VN Index has climbed to new highs, exceeding the 1,500 point benchmark.

Concerns over 'cheap money' on stock market

Recently, the cash flow has poured massively into the stock, gold, and real estate markets. Investors call this phenomenon cheap money, but it also raises concerns over inflation for the economy.

Worrisome concerns about stock market bubble

At the National Assembly last week, there were worrisome arguments about the structure of the budget revenue based on the stock market bubble and the real estate sector.

Trading value at stock market reaches record high

Cash keeps flowing into the stock market, including during trading sessions when the VN Index falls.

Stock market to be turned into main medium and long-term capital channel

After 25 years of development, the Vietnamese stock market is playing a more important role in attracting capital, supporting the commercial banking system.

Market looks for new sources of goods as divestment from state enterprises proceeds

The situation changed in a positive direction when the stock market and and stock prices went up. This will enable divestment from SOEs and the equitization process to take place more easily.

Several listed foreign firms report lower profits and losses in 2020

The majority of foreign-invested enterprises listed on Vietnam's stock market either posted lower after-tax profits or losses in 2020 due to the impact of the COVID-19.

2021's profit outlook mostly reflected in stock prices: FiinGroup

The Vietnamese stock market’s valuation is equivalent to 18.2 times 2021’s profit and 14.3 times 2022’s profit forecast, said Fiin Trade, showing that the profit prospects for 2021 are reflected in share prices.

Securities investors pour billions of dollars a day into market

Billions of dollars are pouring into the stock market each trading session as the prices of some stocks have reached historic peaks.

One million new stock accounts open in 10 months

In the past 10 months, the number of newly opened securities accounts reached nearly 1.1 million, higher than the total number of new accounts in the previous four years.

Business stories: billionaires get richer

The share price increases last week helped rich businesspeople become even richer.

Stock market liquidity exceeds 2.2 billion USD for first time

Liquidity on Vietnam’s stock market hit a new record on November 3 with nearly 52 trillion VND (more than 2.2 billion USD) worth of shares traded on all bourses.

Billionaire owner of VietJet among richest businesswomen in SE Asia

The positive signs in the stock market recently have helped Vietnamese billionaires, including Nguyen Thi Phuong Thao, become richer.

Raking in profits, billionaires earn more money than ever

Pham Nhat Vuong continues setting new records, while Le Phuoc Vu has gained a new high in his business career.

Bankers get richer amid pandemic

Commercial banks have reported profits of trillions of dong in the first nine months of the year, helping their owners get richer while other businesses remain in distress because of the impact of Covid-19.

VN-Index hits new peak on October 27

Accordingly, at the end of the session, the index picked up 31.39 points to 1,423.02 points. Previously, the highest level of VN-Index ever set was 1,420 points, which was recorded in early July.

UPCoM attracts investors thanks to stock potential

The Unlisted Public Company Market (UPCoM) is increasingly attracting investors thanks to the potential of its stocks.

Vietnam's No. 1 billionaire expands investment

Vingroup, the company of Vietnam’s richest man, billionaire Pham Nhat Vuong, has expanded investment in major projects in the fields of electric cars and technology but has not neglected its traditional businesses.

Financial market development: bright future for stock market?

Vietnam’s economy remains heavily dependent on banks’ capital mobilization, whereas credit risks are always lurking, especially during times of economic crisis, as is the case now.