- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

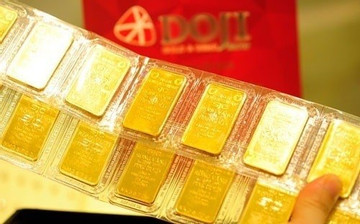

vietnam's gold market

Update news vietnam's gold market

Proposal of compulsory non-cash payment for gold transactions controversy

The General Department of Taxation proposed the State Bank of Vietnam study regulations on making non-cash payments compulsory for gold transactions together with a control mechanism to improve transparency.

VN registers strongest bullion demand since 2015

The World Gold Council’s demand trends report for the first quarter of this year showed that Việt Nam gold demand was strong in the quarter, supporting record-high prices.

State Bank announces 4th gold bar auction to stabilise prices

The State Bank of Vietnam (SBV) on May 7 announced a morning auction for a total of 16,800 taels of gold in Hanoi on May 8.

SJC gold price hits all-time high

SJC-branded gold prices set a new record high on Monday, reaching VNĐ86 million per tael.

Gold at historic peak, auctions receive lukewarm reception

Gold prices reached a historic peak last week after consecutive auction sessions held by the State Bank of Vietnam (SBV) were met with lukewarm enthusiasm.

Fines of VND3 billion imposed on 145 gold trading violators

Authorities have ramped up efforts to combat illegal operations in the volatile gold market, slapping nearly VND3 billion in fines on 145 violation cases this year to date.

SBV cancels gold auction for third time due to lack of bidders

The State Bank of Vietnam (SBV) has announced the cancellation of its gold auction for 16,800 taels of SJC gold this morning, May 3, as just one bidder registered to join the auction.

Will Vietnam have to give up control of the gold market?

After two failures, the State Bank of Vietnam (SBV), experts say, has to lower bidding prices further to VND75 million per tael or give up the gold market, because it is very difficult to stabilize the gold market now.

Central bank to continue gold auction on May 3

The State Bank of Vietnam will auction an additional 16,800 taels of SJC-branded gold bars to businesses at 9am on May 3, it said in a statement released on May 2.

Gold bar prices reach historic high of over VND85 million per tael

The price of domestic gold bars on April 26 continued its upward trajectory, climbing to a historic peak of VND85 million per tael to surpass all previous records.

80% of bullion gold unsold at auction, gold prices continue to fluctuate

Experts say that, like in 2013, the gold auctions are just being done to explore the situation and that the winning volumes are small. However, the fact that 80 percent of gold went unsold on April 23 is worth thinking about.

SBV postpones gold auction for second time

The State Bank of Vietnam (SBV) has announced a postponement of Thursday's gold auction session, as there was only one bidder who submitted a tender.

Auction for gold bullion to continue on April 25

Another bidding session for 16,800 taels of gold bullion will be held on April 25, the State Bank of Vietnam said in a statement.

Central bank successfully auctions 3,400 taels of SJC-branded gold bars

The State Bank of Vietnam (SBV) released the outcome of the gold bullion auction on April 23, with two winning bidders securing 34 lots, equivalent to 3,400 taels of SJC-branded gold bars.

VN central bank cancels gold bar auction

The State Bank of Vietnam announced on April 22 that it has cancelled the auction of SJC-branded gold bars, which had been set for 10am the same day.

VN central bank to sell 16,800 taels of gold bullion to stabilize local market

The State Bank of Vietnam (SBV) is scheduled to hold a gold bullion bidding session on April 23 in an effort to increase the supply of gold bullion and stabilize the domestic gold market that has made national headlines in recent times.

Central bank plans to auction gold bars on April 22

The State Bank of Vietnam (SBV) will auction SJC-branded gold bars on April 22, a representative of the central bank said on April 19.

Gold auction only considered as short-term measure to stabilize market

Despite the SBV’s decision to resume gold auction after 11 years, domestic gold prices are still rather high, meaning this solution is merely situational.

How can gold fever be tamed?

Some analysts have suggested removing the gold monopoly in order to stabilize domestic gold prices, but the removal will not be enough to reach that end.

Government urged to probe gold traders to prevent possible market manipulation

The National Assembly (NA) Standing Committee has asked the Government and the Prime Minister to investigate gold trading firms to promptly address any violations in business activities and possible market manipulation, amid soaring domestic prices.