- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

SBV

Update news SBV

Who are the buyers of bank bonds?

Forty percent of bonds issued by banks are bought by securities companies, but analysts believe that the real bond holders are commercial banks.

Forty percent of bonds issued by banks are bought by securities companies, but analysts believe that the real bond holders are commercial banks.

Resources to deal with bad debts pending

Established six years ago by the government, the Vietnam Asset Management Company (VAMC) has not been very effective.

Established six years ago by the government, the Vietnam Asset Management Company (VAMC) has not been very effective.

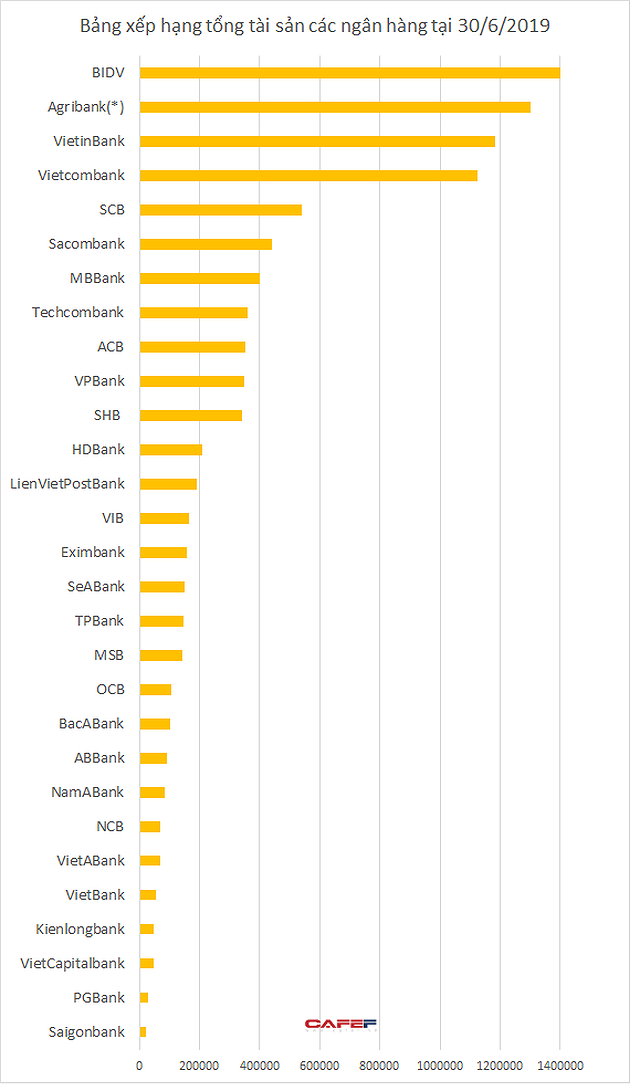

How big are Vietnamese banks?

The 11 top commercial banks have total assets of over $10 billion, while nearly 15 smallest banks have l total assets of less than VND100 trillion. The rankings of banks have changed a lot over the last decade.

The 11 top commercial banks have total assets of over $10 billion, while nearly 15 smallest banks have l total assets of less than VND100 trillion. The rankings of banks have changed a lot over the last decade.

VN banks told to be careful with corporate bonds

Commercial banks’ purchase of real estate corporate bonds is considered indirect lending to real estate firms, experts say.

Commercial banks’ purchase of real estate corporate bonds is considered indirect lending to real estate firms, experts say.

Vietnamese central bank’s anti-dollarization on right track

Experts attributed the success in the fight against the dollarization in the economy to the central bank’s effective policies, including the zero percent dollar deposit interest rate and the foreign exchange stability.

Experts attributed the success in the fight against the dollarization in the economy to the central bank’s effective policies, including the zero percent dollar deposit interest rate and the foreign exchange stability.

Overseas remittances to HCM City on the rise

Overseas remittances to HCM City were estimated to reach $3.45 billion in the first eight months of this year, according to the State Bank of Vietnam’s HCM City branch.

Overseas remittances to HCM City were estimated to reach $3.45 billion in the first eight months of this year, according to the State Bank of Vietnam’s HCM City branch.

VND stable despite trade war escalation

Most currencies have depreciated against the US dollar but the Vietnam dong value has remained stable.

Most currencies have depreciated against the US dollar but the Vietnam dong value has remained stable.

A new race starts for consumer lenders

With an annual 20-30 percent growth rate, the consumer credit market has become an attractive sector.

With an annual 20-30 percent growth rate, the consumer credit market has become an attractive sector.

VN central bank warns credit institutions over rate hikes

The State Bank of Vietnam (SBV) said it will closely monitor interest rates offered by credit institutions and take measures to strictly handle violations of the law, including cutting credit growth targets.

The State Bank of Vietnam (SBV) said it will closely monitor interest rates offered by credit institutions and take measures to strictly handle violations of the law, including cutting credit growth targets.

Taxes, loan interest rates burden VN enterprises

While the EVFTA and CPTPP have paved the way for Vietnamese enterprises to penetrate the world market, high taxes and interest rates have blocked their path.

While the EVFTA and CPTPP have paved the way for Vietnamese enterprises to penetrate the world market, high taxes and interest rates have blocked their path.

VN banks warned about risks of real estate corporate bonds

The State Bank of Viet Nam (SBV) has instructed local banks to better control risks in corporate bond investment, especially bonds of real estate firms.

The State Bank of Viet Nam (SBV) has instructed local banks to better control risks in corporate bond investment, especially bonds of real estate firms.

The ‘big four’ banks thirsty for foreign capital

Initial encouraging results have occurred after efforts were made to reduce the need for capital from banks where the state holds the controlling stake.

Initial encouraging results have occurred after efforts were made to reduce the need for capital from banks where the state holds the controlling stake.

Vietnam cautious about interest rate policy

Vietnam is following a skeptical interest rate policy, with few and minor adjustments.

Vietnam is following a skeptical interest rate policy, with few and minor adjustments.

Asian central banks slash interest rates, and Vietnam may follow

Analysts believe that the State Bank of Vietnam (SBV) should follow the move of other central banks to cut interest rates. This would help ease the burden on businesses.

Analysts believe that the State Bank of Vietnam (SBV) should follow the move of other central banks to cut interest rates. This would help ease the burden on businesses.

Local banks need to build on 1H results

Local banks posted notable results in the first half but a good second half is not a given.

Local banks posted notable results in the first half but a good second half is not a given.

More steps to be taken to downsize foreign currency loans

Commercial banks will no longer allow the provision of mid- and long-term foreign currency loans for offshore payments of imported goods and services from September 30 this year.

Commercial banks will no longer allow the provision of mid- and long-term foreign currency loans for offshore payments of imported goods and services from September 30 this year.

Banks keen on green projects

Green credit is a trend in the global banking and finance industry and more Vietnamese banks are following suit.

Green credit is a trend in the global banking and finance industry and more Vietnamese banks are following suit.

Mobile payments reshaping VN banking

Vietnam is experiencing a boom in mobile payments as more and more e-wallet providers have aggressively joined the market.

Vietnam is experiencing a boom in mobile payments as more and more e-wallet providers have aggressively joined the market.

Vietnam banks step up bad debt recovery in 2019

Some banks have recovered trillions of Vietnamese dong in bad debt by selling off assets secured with non-performing loans in the first half of 2019.

Some banks have recovered trillions of Vietnamese dong in bad debt by selling off assets secured with non-performing loans in the first half of 2019.

VN banks make big profits but share prices fall

Despite good business results, 11 out of 17 listed commercial banks saw share prices decrease in the first half of the year.

Despite good business results, 11 out of 17 listed commercial banks saw share prices decrease in the first half of the year.