- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

SBV

Update news SBV

Experts warn GDP may decline if banks tighten real estate credit

The tightening of real estate credit may deal another blow to the real estate market, which is facing difficulties from all sides, experts say.

The tightening of real estate credit may deal another blow to the real estate market, which is facing difficulties from all sides, experts say.

Foreign investors eye Vietnam’s weak banks

Many large multi-national groups have showed interest in the weak banks Vietnam wants to sell. However, they have not moved ahead to implement the plans.

Many large multi-national groups have showed interest in the weak banks Vietnam wants to sell. However, they have not moved ahead to implement the plans.

Should the state spend money to raise capital in state-owned banks?

Experts can see high risks in using money from the state budget to increase the charter capital of state-owned banks.

Experts can see high risks in using money from the state budget to increase the charter capital of state-owned banks.

Vietnam’s banks strive to meet Basel II standards

Vietnam’s banks are having difficulties meeting Basel II standards, including the quality of database, the qualifications of staff, technology infrastructure, training, and budget for consultants.

Vietnam’s banks are having difficulties meeting Basel II standards, including the quality of database, the qualifications of staff, technology infrastructure, training, and budget for consultants.

Banks report high profits, but decide not to pay dividends

Banks, which all reported big profits for 2018, are using the money to improve their financial capability.

Banks, which all reported big profits for 2018, are using the money to improve their financial capability.

Vietnam’s economy 2019: ‘basket of paddy’ and ‘credit leverage’

The Governor of the State Bank of Vietnam (SBV), Le Minh Hung, is standing firm on low credit growth. This is also an issue that S&P emphasized in in its latest report.

The Governor of the State Bank of Vietnam (SBV), Le Minh Hung, is standing firm on low credit growth. This is also an issue that S&P emphasized in in its latest report.

Billions of VND unspent because of slow disbursement for projects

The State Treasury has mobilized trillions of dong via bond issuance, but still cannot spend the money because of slow disbursement in state-funded projects.

The State Treasury has mobilized trillions of dong via bond issuance, but still cannot spend the money because of slow disbursement in state-funded projects.

SBV attempts to tighten control over consumer lending

The central bank believes that the consumer finance market in Vietnam is still in an early development stage, and needs to be controlled strictly by risk management tools.

The central bank believes that the consumer finance market in Vietnam is still in an early development stage, and needs to be controlled strictly by risk management tools.

Banks ignite ‘zero-dong service’ competition

After Techcombank announced its ‘zero-dong service’ policy, in which its clients pay no fee for some kinds of services, other banks have followed the move.

After Techcombank announced its ‘zero-dong service’ policy, in which its clients pay no fee for some kinds of services, other banks have followed the move.

Banks now targeting SMEs for disbursement

Instead of turning their back to small and medium-sized enterprises (SMEs) as they did in the past, commercial banks are approaching enterprises despite problems in accounting and collateral.

Instead of turning their back to small and medium-sized enterprises (SMEs) as they did in the past, commercial banks are approaching enterprises despite problems in accounting and collateral.

MPOS mobile card payment leads the growth of payment channels in VN in 2018

2018 was the year witnessing the outstanding development of the new payment method via mPOS device.

2018 was the year witnessing the outstanding development of the new payment method via mPOS device.

VN Central Bank asks for tightened control over real estate loans

The State Bank of Viet Nam (SBV) has asked for the control over real estate loans by credit institutions to be enhanced, especially in areas showing signs of land price fever.

No capital shortages for prioritised sectors: VN Central Bank

The banking sector pledged to meet the capital demand for production and business, especially in five prioritised sectors, Deputy Governor of the State Bank of Viet Nam Dao Minh Tu said at a conference in Ha Noi on Tuesday.

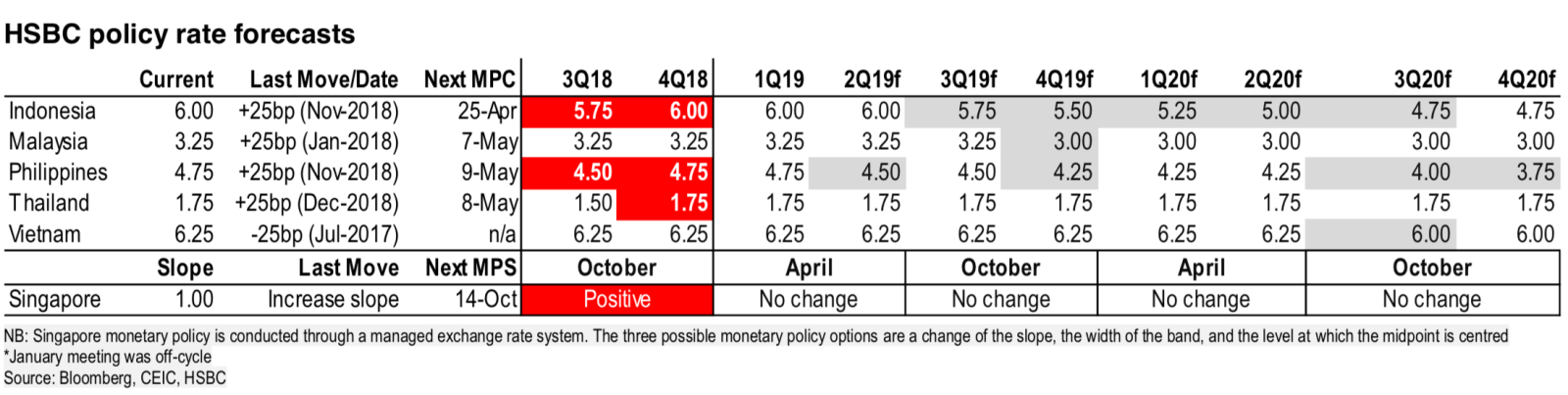

Vietnam expected to cut policy rate in second half of 2020: HSBC

The need to ease policy rates in the near-term is unlikely, given the country’s still-robust growth and heightened foreign direct investment.

Banks cautious about profit targets for 2019

After reaping high profits and gaining growth of 30-40 percent in 2017-2018, Vietnam’s commercial banks have become cautious about their business plans for 2019.

Credit growth limited at 15% for Vietnam's best banks in 2019

The State Bank of Viet Nam (SBV) has assigned a credit growth limit to each commercial bank in 2019, with priority given to those who met Basel II’s capital safety and risk management standards ahead of schedule.

New regulations on use of foreign currencies in Vietnam

The State Bank of Vietnam issued Circular No. 03/2019/TT-NHNN on amending and supplementing a number of articles of Circular No. 32/2013/TT-NHNN guiding the implementation of regulations on restricting the use of foreign currencies in Vietnam.

Foreign banks in Vietnam raise chartered capital

VietNamNet Bridge - Both Vietnamese and foreign banks are rushing to raise their chartered capital to satisfy the requirements of Basel II.

Foreign investors stir up consumer finance market

VietNamNet Bridge - More foreign investors are attempting to take over Vietnam’s finance companies, which are in a ‘golden development stage’.

How are alliances in the banking sector performing?

VietNamNet Bridge - Nearly half of the cooperation agreements between Vietnamese banks and foreign strategic shareholders have been terminated after one decade.