- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

stock market

Update news stock market

Investment funds make more stock purchase despite decling prices

Although the novel coronavirus epidemic COVID-19 has been continuously slamming the stock market, sending stock prices down, many investment funds are still actively buying.

Although the novel coronavirus epidemic COVID-19 has been continuously slamming the stock market, sending stock prices down, many investment funds are still actively buying.

When will Vietnam’s stock market be upgraded?

Rong Viet Securities (VDSC) and Mirae Asset believe that MSCI may upgrade Vietnam’s stock market to an emerging market in 2022-2023, while BSC thinks the upgrade would be prior to 2025 at the earliest.

Rong Viet Securities (VDSC) and Mirae Asset believe that MSCI may upgrade Vietnam’s stock market to an emerging market in 2022-2023, while BSC thinks the upgrade would be prior to 2025 at the earliest.

Expert warns about challenges for financial market in 2020

The financial market faces six risks the market will have to cope with in 2010, according to Can Van Luc, chief economist of BIDV.

The financial market faces six risks the market will have to cope with in 2010, according to Can Van Luc, chief economist of BIDV.

Vietnam may loosen monetary policy to support economic growth

In the first days of the Year of the Rat, the economy has been experiencing unfavorable conditions because of the coronavirus outbreak, originating from Wuhan City, China.

In the first days of the Year of the Rat, the economy has been experiencing unfavorable conditions because of the coronavirus outbreak, originating from Wuhan City, China.

Vietnam’s stock market turns 20 years old in 2020

Despite its young age, the Vietnamese stock market has made great contributions to economic development in the last 20 years.

Despite its young age, the Vietnamese stock market has made great contributions to economic development in the last 20 years.

Vietnam’s stock market overreact to nCoV outbreak

Chair of the State Securities Commission (SSC) Tran Van Dung commented that the investors have ‘overreacted’ to the nCoV outbreak, believing that the market will recover when the epidemic peaks, as it happened with SARS and H5N1.

Chair of the State Securities Commission (SSC) Tran Van Dung commented that the investors have ‘overreacted’ to the nCoV outbreak, believing that the market will recover when the epidemic peaks, as it happened with SARS and H5N1.

The ‘January effect’ in Vietnam’s stock market

The ‘January effect’ hypothesis proved to be true when the Vietnamese stock market saw stock prices increasing in the last 12 out of 19 years in the month of January.

The ‘January effect’ hypothesis proved to be true when the Vietnamese stock market saw stock prices increasing in the last 12 out of 19 years in the month of January.

Stock market remains anxious amid coronavirus outbreak

The outbreak of the acute respiratory disease caused by the novel coronavirus has hit Vietnam’s stock exchange over recent days as shares hit a three-year low.

Vietnam to continue to attract capital even under unfavorable conditions

Private sector development and the expected stock market upgrading will help Vietnam attract foreign capital even if the conditions are not that favorable, according to SSI Research.

Private sector development and the expected stock market upgrading will help Vietnam attract foreign capital even if the conditions are not that favorable, according to SSI Research.

Ministry of Finance warns Song Da Corporation

The MoF announced the financial situation and production of Song Da Corporation, with the total revenue in 2018 reaching $78.26 million, down 32.2 per cent.

Which factors will drive the stock market in 2020?

The stock market in 2019 closed with a VN Index increase of 7 percent, an average achievement, though the macroeconomic indicators were very good and the State Bank loosened monetary policy.

The stock market in 2019 closed with a VN Index increase of 7 percent, an average achievement, though the macroeconomic indicators were very good and the State Bank loosened monetary policy.

Japanese gas firm buys 21% in PV Low Pressure Gas

Japan-based firm Saibu Gas Co Ltd has become the large shareholder in PetroVietnam Low Pressure Gas JSC (PV GasD).

Japan-based firm Saibu Gas Co Ltd has become the large shareholder in PetroVietnam Low Pressure Gas JSC (PV GasD).

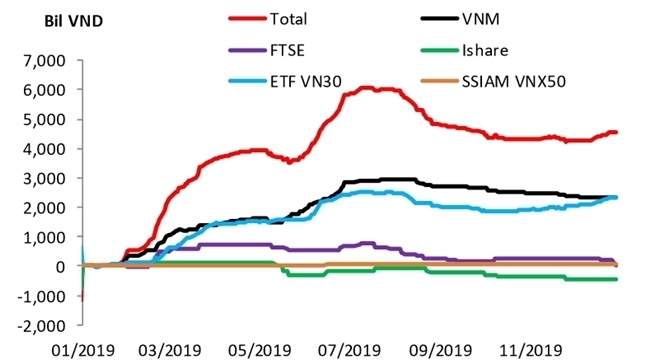

ETF capital expected to increase, affect the stock market

The newly set indexes, plus the possibility of the market upgrading, have led observers to believe that ETF will attract foreign capital.

The newly set indexes, plus the possibility of the market upgrading, have led observers to believe that ETF will attract foreign capital.

Huge capital flows into private sector

The reliance of private enterprises, business households and individuals on bank credit has brought both positive and negative effects.

The reliance of private enterprises, business households and individuals on bank credit has brought both positive and negative effects.

FLC group's stocks attract cash flow

Stocks in the FLC family, especially that of construction firm ROS, drew the attention of investors amid the local market’s slight rebound today, January 14, while liquidity in the local market also significantly improved.

Stocks in the FLC family, especially that of construction firm ROS, drew the attention of investors amid the local market’s slight rebound today, January 14, while liquidity in the local market also significantly improved.

Scenarios for Vietnam's stock market in 2020

Vietnam will celebrate the 20th anniversary of the stock market establishment in 2020.

Vietnam will celebrate the 20th anniversary of the stock market establishment in 2020.

Foreign investors remain net sellers on Hanoi Stock Exchange in 2019

In 2019, foreign investors bought in shares worth VND3.7 trillion (US$159.67 million), but offloaded over US$4.4 trillion (US$189.88 million).

In 2019, foreign investors bought in shares worth VND3.7 trillion (US$159.67 million), but offloaded over US$4.4 trillion (US$189.88 million).

How will investment funds and securities companies fare in 2020?

The VN Index may bounce back and reach the 1,000 point threshold again in 2020, or it may come closer to its peak in 2018 thanks to good macroeconomic conditions, foreign capital flow and reasonable valuations.

The VN Index may bounce back and reach the 1,000 point threshold again in 2020, or it may come closer to its peak in 2018 thanks to good macroeconomic conditions, foreign capital flow and reasonable valuations.

When will Vietnam have the Vietnam Stock Exchange?

One of the major issues stipulated in the amended Securities Law which takes effect on July 1, 2020 is the establishment of the Vietnam Stock Exchange.

One of the major issues stipulated in the amended Securities Law which takes effect on July 1, 2020 is the establishment of the Vietnam Stock Exchange.

State-run Vietnam Rubber Group gets green light to list on HoSE

Once completed listing on the Ho Chi Minh City Stock Exchange, Vietnam Rubber Group would be the second largest firm in terms of registered capital, behind BIDV.

Once completed listing on the Ho Chi Minh City Stock Exchange, Vietnam Rubber Group would be the second largest firm in terms of registered capital, behind BIDV.