- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

stock market

Update news stock market

External factors weigh on investors

The business results of listed enterprises in the first nine months of this year are not so poor. However, uncertainty about the result of talks over the Sino-U.S. trade war makes it harder to forecast the development of Vietnam stock market.

The business results of listed enterprises in the first nine months of this year are not so poor. However, uncertainty about the result of talks over the Sino-U.S. trade war makes it harder to forecast the development of Vietnam stock market.

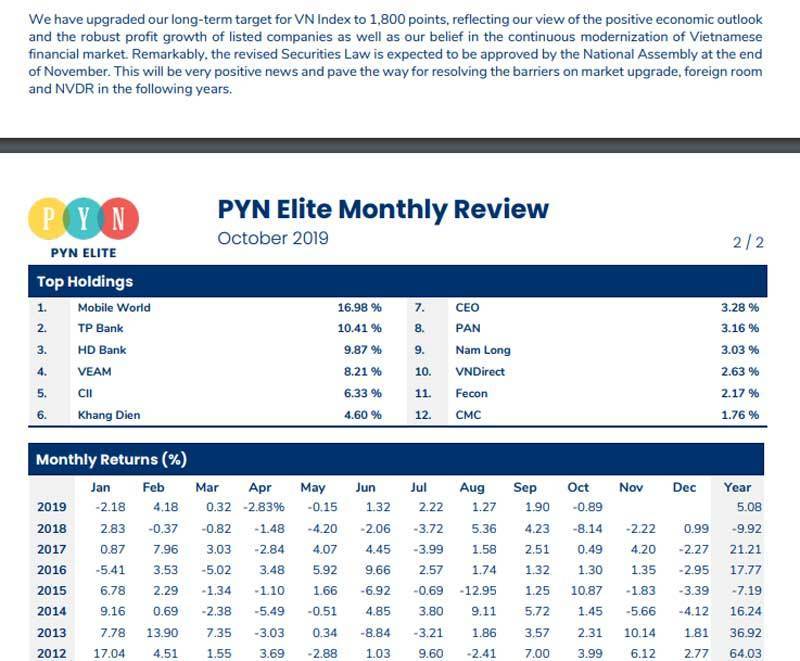

Funds seek profits after stock market officially upgrades

Some active funds are pouring money into the Vietnam’s stock market in anticipation of the market upgrading and are planning to withdraw the money to make a profit when the upgrading is announced.

Some active funds are pouring money into the Vietnam’s stock market in anticipation of the market upgrading and are planning to withdraw the money to make a profit when the upgrading is announced.

Foreign investors sell more than buy in Vietnamese stock market

The Vietnamese stock market is very promising in the eyes of foreign investors. However, the barriers in liquidity and transaction fees have discouraged them.

The Vietnamese stock market is very promising in the eyes of foreign investors. However, the barriers in liquidity and transaction fees have discouraged them.

Vietnam highly likely to be upgraded to second emerging market next September

The upgrade is likely to widen Vietnam’s access to large funds allocated according to the FTSE Emerging Index, including Vanguard FTSE Emerging Market ETF.

The upgrade is likely to widen Vietnam’s access to large funds allocated according to the FTSE Emerging Index, including Vanguard FTSE Emerging Market ETF.

Stock investors turn more cautious after taking loss

The stock market these days is beset with anxiety and cautiousness. Investors cannot predict how the stock prices while foreign investors sell more than buy.

The stock market these days is beset with anxiety and cautiousness. Investors cannot predict how the stock prices while foreign investors sell more than buy.

External factors torment investors in Vietnam

The business results of listed companies in the first nine months of the year were fairly positive. But the unpredictability of the negotiations related to the US-China trade still exists.

The business results of listed companies in the first nine months of the year were fairly positive. But the unpredictability of the negotiations related to the US-China trade still exists.

VN stock market lackluster, investors take losses

Though the index has increased slightly, the stock market remains inactive as a lot of individual investors have incurred losses and many brokers have given up their jobs.

Though the index has increased slightly, the stock market remains inactive as a lot of individual investors have incurred losses and many brokers have given up their jobs.

Foreign funds inject money into Vietnam’s businesses

Just over the last two years, about 10 billion dollars from the region have been poured into Vietnam’s leading corporations.

Just over the last two years, about 10 billion dollars from the region have been poured into Vietnam’s leading corporations.

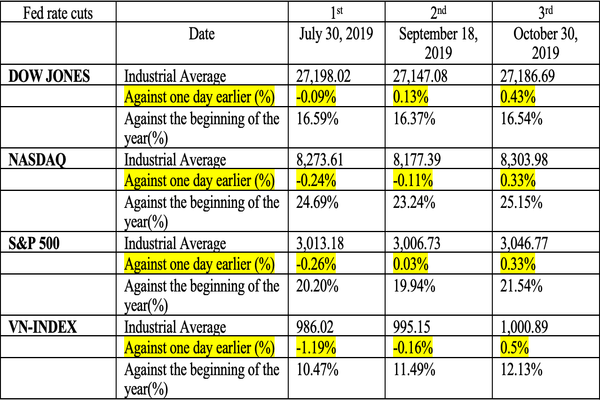

Vietnam’s financial markets respond positively to Fed rate cut

This time, Vietnam’s stock market responded differently compared to the previous two rate cuts with minimal impacts.

This time, Vietnam’s stock market responded differently compared to the previous two rate cuts with minimal impacts.

Vietnam's derivatives pick up in October but signal slowdown in short term

The Vietnamese derivatives market has picked up over the last three weeks, with total trading volume nearly reaching the total figure recorded in September.

The Vietnamese derivatives market has picked up over the last three weeks, with total trading volume nearly reaching the total figure recorded in September.

Vietnamese government bonds attract foreign investors

Foreign investors have made a net purchase of VND15.2 trillion worth of government bonds so far this year, according to SSI Retail Research.

Foreign investors have made a net purchase of VND15.2 trillion worth of government bonds so far this year, according to SSI Retail Research.

South Korean portfolio investment pours into Vietnam

South Korean invested securities companies are putting pressure on Vietnamese companies, competing in terms of service quality, number of branches and the possibility of providing loans for margin trading.

South Korean invested securities companies are putting pressure on Vietnamese companies, competing in terms of service quality, number of branches and the possibility of providing loans for margin trading.

Finance ministry to announce over 750 firms delaying listing

A list of 755 enterprises failing to register to list on the stock market after equitisation will soon be announced.

A list of 755 enterprises failing to register to list on the stock market after equitisation will soon be announced.

Trade wars, quarterly earnings to keep VN stocks down in September

The market sentiment will remain lateral in September weighed down by global economic and political tensions while trading quiet amid speculations of Q3 corporate earnings.

The market sentiment will remain lateral in September weighed down by global economic and political tensions while trading quiet amid speculations of Q3 corporate earnings.

Vietnamese investors unhappy as stock liquidity falls

As liquidity has been falling and investors have taken losses, buying and selling activity has slowed.

As liquidity has been falling and investors have taken losses, buying and selling activity has slowed.

Stock market gains Taiwanese touch

Taiwanese investors are making their way into Vietnam’s stock arena, lured in by a fast-growing economy and a more mature financial market. However, some hurdles need to be removed to attract more capital.

Taiwanese investors are making their way into Vietnam’s stock arena, lured in by a fast-growing economy and a more mature financial market. However, some hurdles need to be removed to attract more capital.

Vietnamese stock market attracts foreign investment

Vietnam’s stock market has been evaluated as a bright spot in the region in terms of growth speed and foreign capital absorption for years, according to Chairman of the State Securities Commission (SSC) Tran Van Dung.

Vietnam’s stock market has been evaluated as a bright spot in the region in terms of growth speed and foreign capital absorption for years, according to Chairman of the State Securities Commission (SSC) Tran Van Dung.

Share price slump may hinder Vietcombank’s plan

Vietcombank is offering to sell 6.5 percent of shares to foreign investors this year in a plan to raise charter capital.

Vietcombank is offering to sell 6.5 percent of shares to foreign investors this year in a plan to raise charter capital.

Developing bond market can help satisfy demand for capital

Vietnamese enterprises are in dire need of capital to expand production and business, but the current development of the capital market cannot meet this demand.

Vietnamese enterprises are in dire need of capital to expand production and business, but the current development of the capital market cannot meet this demand.

Vietnam’s securities companies begin playing new game

A number of securities companies now are earning big money from corporate bonds.

A number of securities companies now are earning big money from corporate bonds.