- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

VN Index

Update news VN Index

Vietnam’s stock market turns 20 years old in 2020

Despite its young age, the Vietnamese stock market has made great contributions to economic development in the last 20 years.

Despite its young age, the Vietnamese stock market has made great contributions to economic development in the last 20 years.

Vietnam’s stock market overreact to nCoV outbreak

Chair of the State Securities Commission (SSC) Tran Van Dung commented that the investors have ‘overreacted’ to the nCoV outbreak, believing that the market will recover when the epidemic peaks, as it happened with SARS and H5N1.

Chair of the State Securities Commission (SSC) Tran Van Dung commented that the investors have ‘overreacted’ to the nCoV outbreak, believing that the market will recover when the epidemic peaks, as it happened with SARS and H5N1.

The ‘January effect’ in Vietnam’s stock market

The ‘January effect’ hypothesis proved to be true when the Vietnamese stock market saw stock prices increasing in the last 12 out of 19 years in the month of January.

The ‘January effect’ hypothesis proved to be true when the Vietnamese stock market saw stock prices increasing in the last 12 out of 19 years in the month of January.

Investment funds change strategies

Following a volatile 2018 which witnessed the US-China trade war, the stock market in 2019 was gloomy with the VN Index hovering around 900-1,000 points.

Following a volatile 2018 which witnessed the US-China trade war, the stock market in 2019 was gloomy with the VN Index hovering around 900-1,000 points.

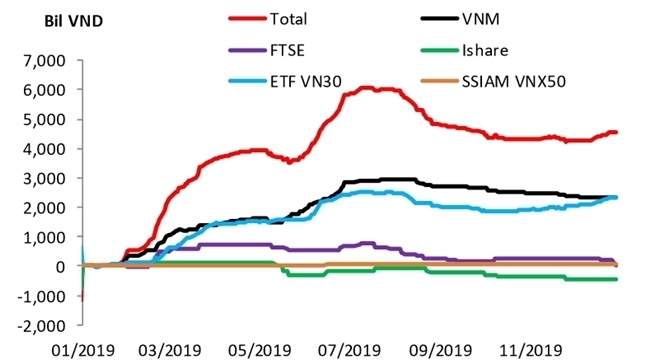

ETF capital expected to increase, affect the stock market

The newly set indexes, plus the possibility of the market upgrading, have led observers to believe that ETF will attract foreign capital.

The newly set indexes, plus the possibility of the market upgrading, have led observers to believe that ETF will attract foreign capital.

Which industries will prosper in 2020?

The experts attending the Vietnam Investment Professionals Forum (VIPF) all predicted that the picture of the Vietnamese stock market would be bright in 2020 with the VN Index likely to exceed 1,200 points.

The experts attending the Vietnam Investment Professionals Forum (VIPF) all predicted that the picture of the Vietnamese stock market would be bright in 2020 with the VN Index likely to exceed 1,200 points.

Foreign investors pour big money into VN bonds

While foreign investors continue selling in the share market, they have been buying more than selling in the bond market since early 2019.

While foreign investors continue selling in the share market, they have been buying more than selling in the bond market since early 2019.

Scenarios for Vietnam's stock market in 2020

Vietnam will celebrate the 20th anniversary of the stock market establishment in 2020.

Vietnam will celebrate the 20th anniversary of the stock market establishment in 2020.

How will investment funds and securities companies fare in 2020?

The VN Index may bounce back and reach the 1,000 point threshold again in 2020, or it may come closer to its peak in 2018 thanks to good macroeconomic conditions, foreign capital flow and reasonable valuations.

The VN Index may bounce back and reach the 1,000 point threshold again in 2020, or it may come closer to its peak in 2018 thanks to good macroeconomic conditions, foreign capital flow and reasonable valuations.

Vietnam among the most attractive stock markets in 2019

Vietnam was still attractive to investors in 2019 despite global caution about US President Donald Trump’s policies.

Vietnam was still attractive to investors in 2019 despite global caution about US President Donald Trump’s policies.

Ten important hallmarks of Vietnam’s stock market in 2019

The Vietnamese stock market has been growing rapidly with market capitalization value exceeding 100 percent of GDP.

The Vietnamese stock market has been growing rapidly with market capitalization value exceeding 100 percent of GDP.

Funds seek profits after stock market officially upgrades

Some active funds are pouring money into the Vietnam’s stock market in anticipation of the market upgrading and are planning to withdraw the money to make a profit when the upgrading is announced.

Some active funds are pouring money into the Vietnam’s stock market in anticipation of the market upgrading and are planning to withdraw the money to make a profit when the upgrading is announced.

Foreign investors sell more than buy in Vietnamese stock market

The Vietnamese stock market is very promising in the eyes of foreign investors. However, the barriers in liquidity and transaction fees have discouraged them.

The Vietnamese stock market is very promising in the eyes of foreign investors. However, the barriers in liquidity and transaction fees have discouraged them.

Stock investors turn more cautious after taking loss

The stock market these days is beset with anxiety and cautiousness. Investors cannot predict how the stock prices while foreign investors sell more than buy.

The stock market these days is beset with anxiety and cautiousness. Investors cannot predict how the stock prices while foreign investors sell more than buy.

External factors torment investors in Vietnam

The business results of listed companies in the first nine months of the year were fairly positive. But the unpredictability of the negotiations related to the US-China trade still exists.

The business results of listed companies in the first nine months of the year were fairly positive. But the unpredictability of the negotiations related to the US-China trade still exists.

VN stock market lackluster, investors take losses

Though the index has increased slightly, the stock market remains inactive as a lot of individual investors have incurred losses and many brokers have given up their jobs.

Though the index has increased slightly, the stock market remains inactive as a lot of individual investors have incurred losses and many brokers have given up their jobs.

Vietnamese businesses still reluctant to list shares

The number of companies which listed shares or are planning to list shares in 2019 remains very modest.

The number of companies which listed shares or are planning to list shares in 2019 remains very modest.

Vietnamese government bonds attract foreign investors

Foreign investors have made a net purchase of VND15.2 trillion worth of government bonds so far this year, according to SSI Retail Research.

Foreign investors have made a net purchase of VND15.2 trillion worth of government bonds so far this year, according to SSI Retail Research.

South Korean portfolio investment pours into Vietnam

South Korean invested securities companies are putting pressure on Vietnamese companies, competing in terms of service quality, number of branches and the possibility of providing loans for margin trading.

South Korean invested securities companies are putting pressure on Vietnamese companies, competing in terms of service quality, number of branches and the possibility of providing loans for margin trading.

Vietnam stocks to beat 1,000 points in Q4

Vietnam’s benchmark VN-Index could breach the 1,000 point mark in the last quarter of the year after the Q3 corporate earnings season and with investors shifting attention towards firms with hopes for full-year earnings growth.

Vietnam’s benchmark VN-Index could breach the 1,000 point mark in the last quarter of the year after the Q3 corporate earnings season and with investors shifting attention towards firms with hopes for full-year earnings growth.