- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

VN Index

Update news VN Index

Bank shares in demand as banks report huge profits

The capitalization value of some banks has increased by one billion dollars within a short time.

Land speculation continues, realtors incur big losses

A leading Vietnamese real estate developer has reported an additional loss of tens of billions of dong, raising its total loss in 2020 to VND500 billion, though land prices are escalating all over the country.

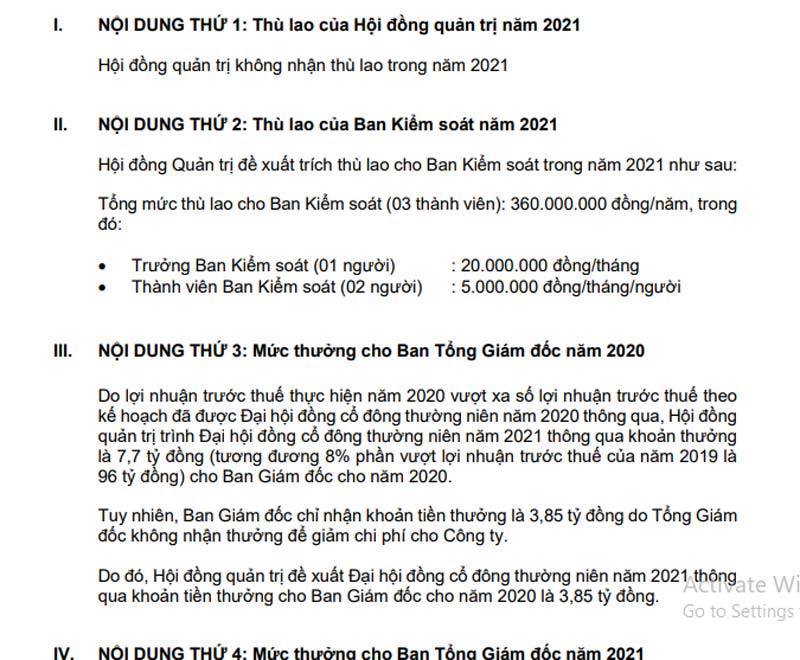

Many business leaders refuse salaries, but still pocket big money

The chair of Viet Capital Securities has received zero dong, and the CEO has refused a bonus worth an apartment, buy they still earn money through shares they hold.

Upheavals in banking sector: many managers are replaced

During this year’s shareholders’ meeting season, big changes in shareholders’ structure have been made and many bank managers have been replaced.

Billionaire concludes major deal

FLC of billionaire Trinh Van Quyet has seen the share price soar amid the HCM City Stock Exchange’s (HOSE) notice about the businessman’s plan to buy 15 million shares.

Stock market turbulence: $35 billion lost

The stock market continued to decline with another $12 billion lost, following the loss of $23 billion one month before.

Vinasun taxi incurs heavy losses, thousands of workers lose jobs

Vinasun, the No 1 taxi company in the taxi market, is bogged down in difficulties amid the appearance of of ride-hailing firms and the Covid-19 pandemic.

Steel mogul lives secluded life, but still makes important decisions for Hoa Sen

Le Phuoc Vu, president of Hoa Sen Group, a large steel sheet manufacturer, continues to lead a secluded life on a mountain. However, he continues to make important decisions for Hoa Sen, which had an impressive business performance in 2020.

Stock market plummets, $10 billion lost

The Vietnamese stock market saw an unprecedented plunge on January 19. But panic did not occur.

VN stock market 2020: many ups and downs

The stock market witnessed rare strong fluctuations in 2020, reflecting the historical fear and strong expectations of investors.

Foreign capital returns strongly to Vietnam

There are signs of foreign capital returning to Vietnam in the context of global stabilization. Vietnam has a great opportunity to break out thanks to the rapid recovery from Covid-19 and its open economy.

Emerging after one decade of hiding, tycoon gets a shock

The enterprise of Dang Thanh Tam, who was once the richest businessman in Vietnam, has reported bad news as it did nearly a decade ago.

Nguyen Thanh Phuong’s business borrows trillions of dong for ‘new game’

Following a report about unsatisfactory business results, the business of Nguyen Thanh Phuong, a well-known businesswoman, is mobilizing capital for new business plans.

Billionaire shows his power, buys FLC shares at high prices

Trinh Van Quyet, president of FLC Group, has decided to spend nearly VND100 billion to buy FLC shares, though prices have increased sharply recently.

Large corporations receive hundreds of million dollars in investment from Japan

The good relations between Japan and Vietnam are fueling Japanese capital flow into Vietnamese enterprises through portfolio investments.

Securities companies report big profits, but Viet Capital sees sharp fall in profits

Viet Capital Securities (VCSC) of Nguyen Thanh Phuong has been showing signs of decline recently, but the stock market is brightening with strong liquidity.

Taking losses for 10 years and selling assets to pay debts, boss Duc is still ultra rich

The businesses of Doan Nguyen Duc, or ‘boss Duc’ as he is called in Vietnam, have been facing difficulties. Although the owner of Hoang Anh Gia Lai Group has had to sell many assets, he remains a stock billionaire.

Needing VND500 billion, boss Thuy mortgages assets at Kim Lien Hotel

Nguyen Duc Thuy, or boss Thuy, as he is known in Vietnam, is taking daring steps by mortgaging 819,450 shares issued by Kim Lien Tourism JSC held by Thaiholdings for a loan.

Mystery businessmen pours VND150 billion into ITA, Dang Thi Hoang Yen makes surprise move

The ITA shares of the Tan Tao Group unexpectedly witnessed an impressive trading session with a record high trading volume.

Multi-trillion VND helps VN-Index regain peak

The strong cash flow to the stock market in recent days has helped stock prices bounce back.