- © Copyright of Vietnamnet Global.

- Tel: 024 3772 7988 Fax: (024) 37722734

- Email: evnn@vietnamnet.vn

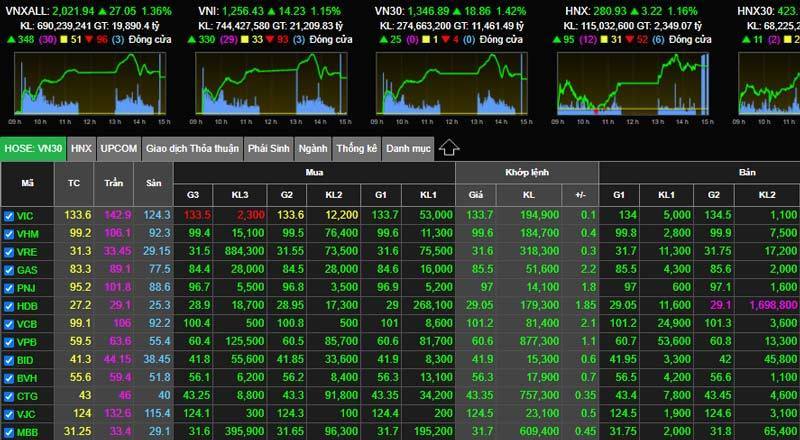

VN Index

Update news VN Index

VN-Index rallies strongly after Fed’s third consecutive interest rate rise

Tuning in with the upbeat sentiment of the US stock market, the VN-Index also climbed robustly in the trading session on July 28 after the US Federal Reserve decided to raise interest rates for the third consecutive time.

Vietnamese shares fall as large-caps drag

Heavyweight stocks dragged Vietnamese’s blue-chip share indices lower on Tuesday, pressuring the overall stock market amid weakening market sentiment.

VN-Index fails to breach 1,200 points on persistent selling force

The market traded two different ways on Friday with the VN-Index failing to cross the psychological level of 1,200 points, as rising selling pressure outweighed demand for riskier assets.

VN stocks could be in sweet spot as GDP growth surges, stronger growth forecast

The Vietnamese economy grew by 7.7 per cent in the second quarter, one of the fastest rates in a decade, and is expected to expand even faster this quarter, driven by an ongoing burst of consumption.

Indices fluctuate on mixed driving forces

Indices witnessed mixed performance on Thursday, as the uptrend was cushioned by many large-cap stocks, however, lingering selling pressure capped gains.

Capitalization value plunges, retail billionaires experiencing dark days

Just within the first 15 days of Q3, the capitalization value of retail companies fell by tens of trillions of dong.

Stock market best understood by professional investors

During the last seven to eight trading sessions, the VN Index suddenly went down and then up again to bottom at 1,150 points. The Index almost stood still and always looked like it was going to break bottom.

VN-Index regains nearly 9 points, backed by securities stocks

Several securities stocks hit the ceiling due to the strong increase in demand and high buying prices after the information that the securities settlement cycle T+2 will be applied in August.

HoSE, HNX see many enterprises leave the market

Most of the delisting cases on HoSE and HNX were due to losses fore three consecutive years, the auditor’s refusal to give an opinion, or the financial statements of three consecutive years with qualified options.

Stock market expected to cross current threshold

During the last trading sessions of 2021, the stock market was not particularly active. The effect was being felt of unfavorable news on the macro, the most notable of which was the GDP growth of the whole year at only 2.58%.

VN-Index ends final session of 2021 up

Closing the final trading session of 2021 today, December 31, the VN-Index of the Hochiminh Stock Exchange gained 12.31 points, extending its rally for the second day, as many big-cap stocks moved into positive territory.

Stock market 2021: records broken

Covid-19 posed difficulties to many people in 2021, but not to securities investors. They earned big money as the VN Index climbed to new highs.

Vietnam Stock Exchange makes debut

The Vietnam Stock Exchange (VNX) made debut on December 11, on the basis of merging the Hanoi Stock Exchange (HNX) and the Ho Chi Minh Stock Exchange (HoSE).

Securities investors pour billions of dollars a day into market

Billions of dollars are pouring into the stock market each trading session as the prices of some stocks have reached historic peaks.

Vn-Index predicted to hit 1.500-mark in H2

All factors are pointing to a positive prospect of Vietnam’s stock market by the end of this year.

Factors keeping capital flowing into Vietnam stock market remain unchanged

The mid-term outlook of the market remains bright, but in short-term, investors may face certain risks.

HOSE technical problems continue despite promises to fix the problems

The stock market is witnessing trading sessions with sharp declines amid technical problems that have gone unresolved for years despite repeated promises from the management agency.

Billions of US dollars flow into Vietnam’s stock market despite Covid-19

The stock market has been witnessing unprecedented cash inflow so far this year, even though the Covid-19 pandemic has become more complicated in Southeast Asia.

Vaccines yet to come, but biotech share prices escalate

Biotech shares, especially the shares of vaccine producers, are being sought by investors.

Share prices rise, strong cash flow emerges

Vietnam’s stock market made a spectacular breakthrough in the first months of the year with the VN Index staying at the 1,200 point threshold and some blue-chip prices strongly increasing.